10 things to watch in the stock market Tuesday including Palo Alto and Home Depot earnings

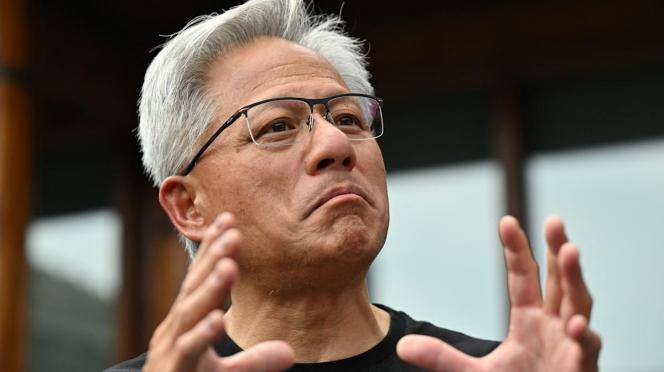

The Club’s 10 things to watch Tuesday, Aug. 19 1. Club name Palo Alto Networks answered the bell with its quarterly results and guidance, sending shares up 6% this morning. The numbers make it clear that Palo Alto’s blockbuster CyberArk acquisition was made from a position of strength , not weakness in its core business. Bank of America upgraded the stock to buy from hold. Plenty of price target hikes, too. 2. Home Depot stood by its full-year guidance despite issuing weaker-than-expected quarterly sales and profits this morning. Cadence was good, with same-store sales rising in each month of the quarter: 0.3% in May, 0.5% in June and 3.3% in July. Shares added more than 1%, but Federal Reserve interest rate cuts are needed to really unlock the housing market and this Club stock. 3. We’re headed toward another subdued open this morning after a tame session yesterday. Wall Street is bracing for more retail earnings this week, including Club name TJX on Wednesday morning, as a way to gauge the health of the consumer, and Fed Chairman Jerome Powell’s Jackson Hole speech on Friday. 4. A meeting between Ukrainian President Volodymyr Zelenskyy and Russia’s Vladimir Putin is being planned , President Donald Trump said yesterday, after convening Zelenskyy and European leaders at the White House. From there, Trump said a trilateral meeting as part of peace talks would occur. 5. Japan’s SoftBank is investing $2 billion into struggling American chipmaker Intel . We also got more details on the White House’s desires: It’s considering taking a 10% stake by converting at least some Chips Act grants into equity, according to Bloomberg News . Intel shares rose 5% this morning. 6. Club name Nvidia is working on a fresh AI chip for the Chinese market that outperforms the H20, its throttled-back version of Hopper chips created in response to U.S. restrictions, Reuters reported today . The new chip would be based on Nvidia’s Blackwell architecture, Reuters said. Treasury Secretary Scott Bessent told CNBC that Nvidia would need an export license for any H20 successor. 7. Shares of Viking Therapeutics plunged nearly 30% this morning after the biotech firm released midstage trial results of its oral obesity drug. While Viking said the trial met its primary endpoint on weight reduction, a 28% discontinuation rate is likely spooking investors. Club stock Eli Lilly , which had its own disappointing obesity pill data earlier this month, added over 1%. 8. Apple is boosting iPhone manufacturing in India, Bloomberg News reported, as part of the Club holding’s strategy to reduce its reliance on China for products heading to the U.S. All four versions of the soon-to-launch iPhone generation will be made in India, which is the first time that’s happened from the outset, according to Bloomberg. 9. Medtronic is shaking up its board with two new directors after the influential activist hedge fund Elliott Management took a big stake in the medical device maker. Elliott was a driving force behind Club stock Honeywell’s impending breakup plans. 10. More evidence of a pickup in mergers and acquisitions: Local TV station owner Nexstar Media is buying smaller rival Tegna in a deal worth $6.2 billion, including debt. Club name Goldman Sachs is among the firms that served as financial advisors to Nexstar. It’s also committed financing for the transaction. Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free (See here for a full list of the stocks at Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.