At the start of 2019, actively managed exchange-traded funds represented just 2% of the US ETF market. Since then, the organic growth of active ETFs has consistently exceeded 20% per year. The number of active ETFs exploded fivefold and assets grew seven times over the past five years. But active ETFs are still just scratching the surface.

Investors can benefit from ETFs’ tax efficiency and lower fees. Just 4% of active ETFs distributed capital gains last year versus 61% of mutual funds. And active ETFs with a substantially similar mutual fund strategy tend to be priced near or below institutional share class fee levels, giving retail investors cheaper access to the same strategy. These advantages should have investors thinking twice before going back to the mutual fund well. Here are three great active stock ETFs to consider.

Dimensional US Core Equity 2 ETF

The first ETF is Dimensional US Core Equity 2 ETF DFAC, which receives a Morningstar Medalist Rating of Gold for its diversified portfolio, low fee, and mild factor tilts that should provide a long-term edge.

The fund offers broad exposure to stocks of all sizes listed in the US, and it emphasizes those with lower valuations, higher profitability, and smaller market capitalizations. This technique has two advantages. First, it tilts toward factors that have historically been associated with superior long-term returns, which should give the fund an edge when those styles are in favor. Second, it cuts back on turnover and trading costs because a stock’s market cap is incorporated into the weighting scheme.

This ETF holds over 2,500 stocks and charges just 17 basis points, two reasons why it’s one of the most widely held active ETFs by investors. Recent performance has been mediocre as high-growth names have led the market, but this ETF could offer a contrarian approach to market-cap-weighting without giving up on stocks like Tesla TSLA or Nvidia NVDA altogether.

Compare the weightings of the market’s top 10 holdings compared with those of DFAC:

Capital Group Dividend Value ETF

The second ETF on my list is Capital Group Dividend Value ETF CGDV. This Silver-rated ETF follows a discretionary active approach. Its long-tenured team picks stocks by combining an eye toward quality with an emphasis on income.

The strategy takes on a dividend-growth tack by investing in stocks with a long history of paying dividends. But its managers can invest up to 10% in non-dividend-payers, allowing the portfolio to maximize the team’s fundamental research while still hitting its yield target.

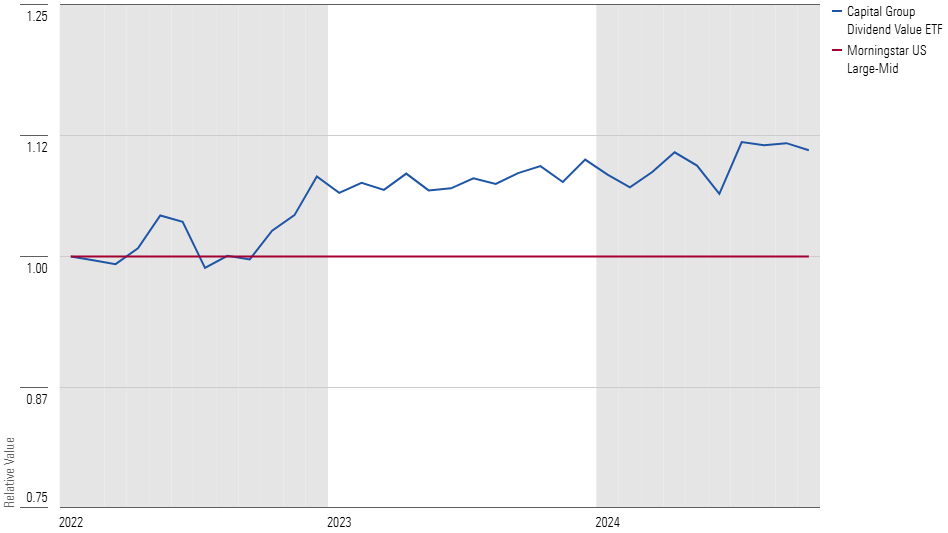

Launched in the throes of 2022’s decline, this ETF has easily outperformed large-value peers and even beat the Morningstar US Large-Mid Cap Index by over 3 percentage points since inception.

Avantis International Equity ETF

The third ETF on my list is Avantis International Equity ETF AVDE. This Silver-rated ETF combines a broad portfolio with mild factor tilts, similar to the approach taken by the Dimensional ETF.

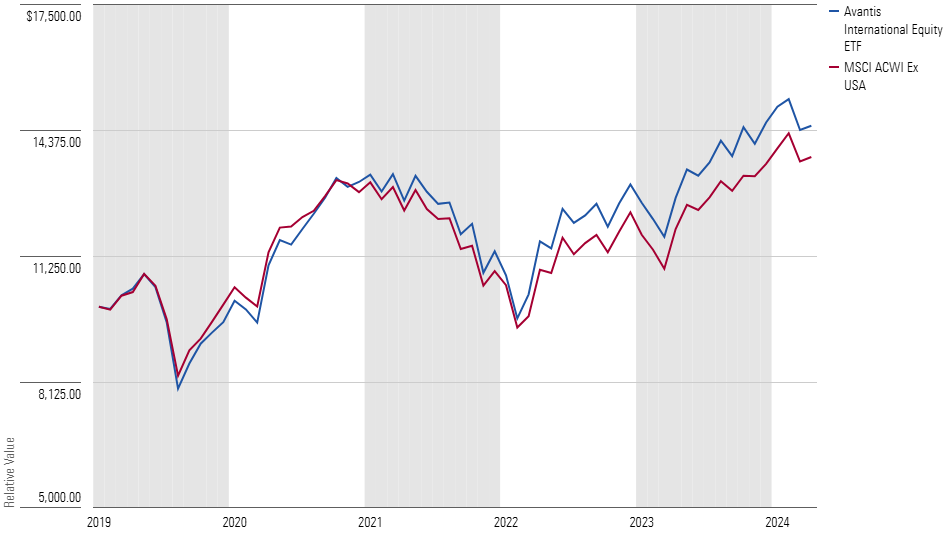

Avantis pulls in developed-markets stocks of all sizes and overweights those with lower price/book multiples and higher profitability. Its systematic approach understates the value generated by its active management of the portfolio, which allows the ETF to limit trading costs and maximize tax efficiency. As a result, the fund has proved adept at beating indexed peers.

International investing hasn’t produced gaudy returns recently, but markets tend to move in and out of favor over the long run. This ETF provides active management on a portfolio of over 3,000 international stocks for a fee of just 0.23%, and it has earned an annualized 1.15 percentage point advantage over its category index since its 2019 inception.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.