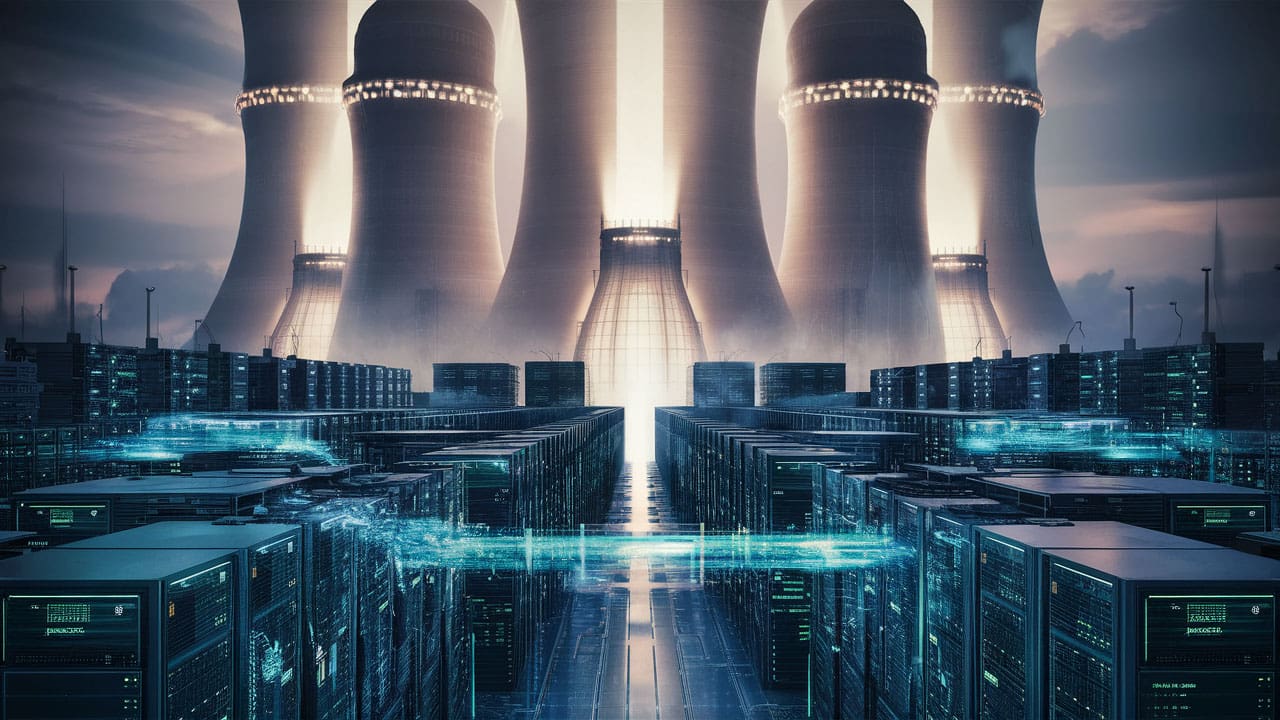

According to their most recent quarterly reports, Alphabet (which owns Google), Amazon and Microsoft—the world’s cloud-computing giants — collectively invested $40 billion between January and March, in data centers to deal with growing Artificial-Intelligence (AI) workloads.

The future of our world will revolve heavily around AI but as it becomes a more permanent fixture in our lives there’s a major problem that needs to be solved. How do countries create enough power and storage to meet the growing needs of AI.

To give you a better perspective of just how much energy AI uses, let’s examine the energy needs of the most popular AI tool in the world right now which is ChatGPT.

When you ask a simple question to ChatGPT it uses 10x more energy than running a search on Google. And if you use it to generate a single image, that procedure uses enough power to drain a smartphone battery by at least 25%. Now let’s do the math.

ChatGPT currently has over 180 million users worldwide with the site generating over 1.6 billion site visits each month. Simply put, the energy needs of this single tech company are astronomical and more than anyone can comprehend and this is where things get interesting.

In 2022, America’s four biggest tech companies Amazon, Google, Microsoft and Facebook together consumed 90TWh of electricity which was as much as the entire country of Columbia used in 2022. According to the IEA, data centers will use more than 800TWh in 2026 which illustrates the kind of power required to be added to the grid.

As a matter of fact, there have been reports that some towns are turning down data center construction due to their high energy demand.

Bloomberg also recently researched earnings transcripts of energy companies listed on the S&P 1500 and published the results below showing the number of times data centers were mentioned during earnings calls in the last five years. The second quarter of 2024 was an outlier showing explosive growth and proving that data centers are indeed the future of energy consumption.

That could perhaps explain why OpenAI’s chief, Sam Altman, is betting on nuclear power to power these data centers. Data center company Wyoming Hyperscale already announced that it would be buying 100MW of energy from Altman’s SMR startup Oklo. This means that US domestic uranium suppliers could be primed for major upside as nuclear reactors start up again.

As a matter of fact, the U.S. federal government said it would provide a $1.5 billion loan to restart a nuclear power plant in southwestern Michigan last month. Holtec International acquired the 800-megawatt Palisades plant in 2022 with plans to dismantle it. But now the emphasis is on restarting it by late 2025, following support from the state of Michigan and the Biden administration.

Right now the U.S. is the world’s largest producer of nuclear power but the problem is that it imports 90% of its annual uranium requirement. For a long time now the U.S. has heavily relied on Russia, Kazakhstan, and Uzbekistan for nearly 50% of its uranium supply. This won’t be the case for too long however, considering that on April 30, the Senate voted to approve legislation banning the import of enriched uranium from Russia.

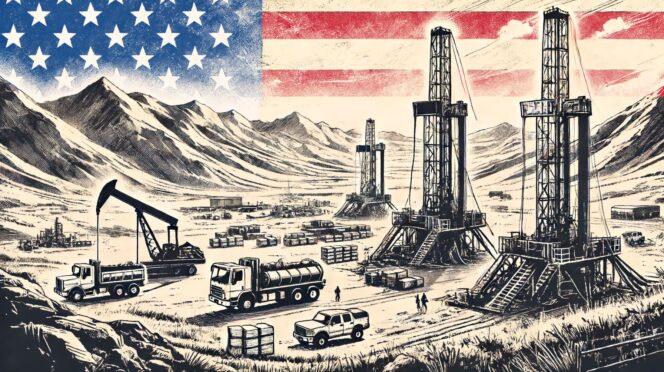

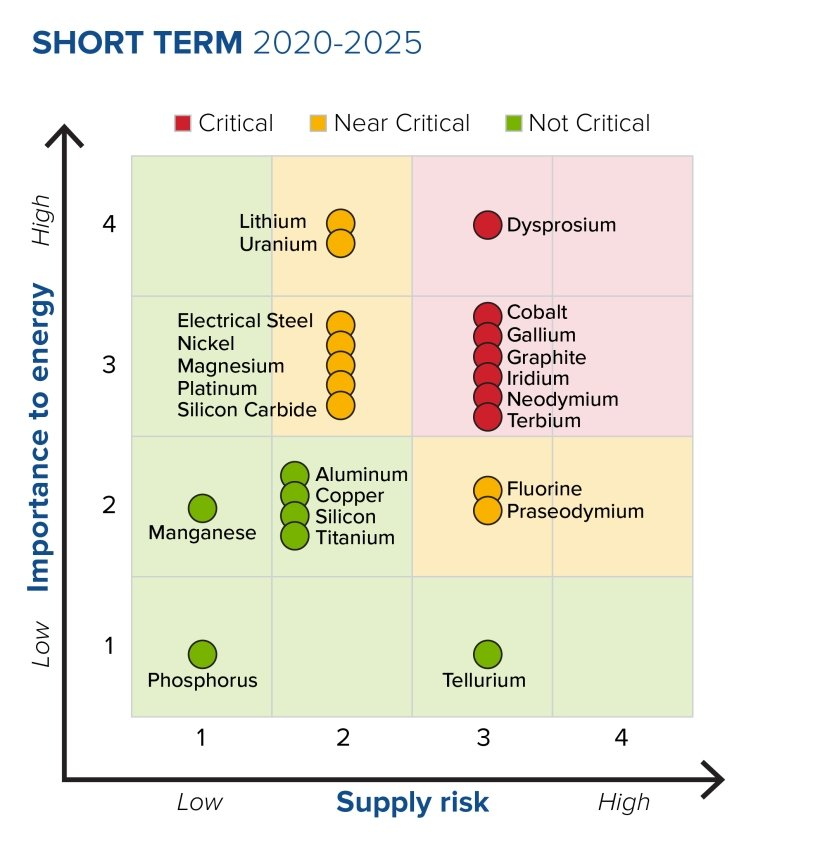

All of this falls in line with the onshoring and an urgent domestic need for US soil based uranium and other critical metal deposits with the potential for size and production. Uranium is now high on the latest US critical minerals list as an imperative mineral for domestic supply. This should bode well for the permitting and development of US uranium and other critical metals. The government is already well on its way to moving in this direction with many other critical metals as shown by the recent Biden Administration’s decision on the imports of Nuclear Fuel .Biden signs into law ban on Russian nuclear reactor fuel imports

For instance, Panther Minerals Inc. (CSE:PURR) (OTC:GLIOF) (FWB:2BC) is looking to strengthen U.S. energy independence through the exploration and development of the Boulder Creek Project, a district-scale uranium project located on the Seward Peninsula in northwestern Alaska.

In addition to the large land package, we believe that Panther is well positioned to benefit from the expected increase in onshore US based uranium demand.

The Boulder Creek Uranium Deposit is conveniently located with access to an existing air strip and infrastructure. It is just 50 km from Elim and 170 km from Nome, which serves as the regional transportation and service hub.

Discovered in 1977 in western Alaska, by means of airborne radiometric data, It was first explored by Houston Oil & Minerals between 1979 and 1981 which completed 52 core holes (3,463 m) and about 60 m of near-surface split-tube sampling in 21 holes⁹.

Triex Minerals then took over exploration of the property from between 2006 – 2008. Triex’s drilling efforts consisted of 14 core holes totaling 1,237 meters, primarily concentrated on the Boulder Creek deposit.

These findings determined that the historic calculated deposit could total 1,000,000 lbs. of U3O8 (non 43-101 compliant) with an average grade of 0.27% U3O8 over a thickness of 3m.

According to Panther, these findings indicate that there may be massive untapped discovery potential which is why the company decided to consolidate the mining districts near Boulder Creek which expanded the land package by ~75x from 90 hectares to 9,065 hectares, setting the stage for large-scale exploration.

Leveraging $3.5 million+ previously spent on exploration and building on the foundational fieldwork and initial drilling by Houston Oil & Minerals and by Triex, Panther Minerals is setting the stage for a comprehensive summer campaign.

Panther Minerals intends to start by further examining areas northwest of the Boulder Creek area, extending some 25 kilometers along the western margin of the basin towards and beyond the Fireweed showing (discovered by Triex in 2007) on the south flank of the eastern Bendeleben mountains.

This decision was prompted by the fact that historical airborne radiometric anomalies at Fireweed are stronger and more widespread than at Boulder Creek warranting detailed exploration and evaluation².

Panther Minerals approach includes a detailed reassessment of the previous drilling data combined with the application of modernized geochemical and geophysical techniques, assembling field personnel, and establishing a base camp for initiating surface geology and re-testing historical drill targets. By reevaluating geological data and utilizing modern exploration techniques, they aim to unlock its perceived full potential.

With a historical resource estimate in hand, the summer 2024 work program should be instrumental in unlocking more shareholder value. Positioned to benefit from US domestic mandates

The recent sanctions on Russian uranium imports have disrupted global supply chains, increasing the reliance on domestic and allied sources. The US government has shown strong support for domestic uranium production, with significant investments in nuclear energy infrastructure and policy support for new projects.

The future of uranium looks promising. Projections indicate a substantial increase in demand, driven by the need for clean and reliable energy sources. Innovations such as small modular reactors (SMRs) are expected to further boost uranium demand.

Panther Minerals expects to capitalize on this growing demand. With a robust exploration plan and a strategic location, the company offers a compelling investment opportunity. The current investor interest in new uranium opportunities puts Panther in the spotlight with its quality uranium exploration assets.

For more information on Panther Minerals and to follow all of their exploration and development work, please visit the Panther Minerals site at pantherminerals.ca (CSE:PURR) (OTC:GLIOF) (FWB:2BC).

Disclaimer: Panther Minerals Inc. has paid for and sponsored this coverage. Omni8 Communications Inc. has been paid CAD$125,000 plus GST to provide online advertisement coverage for Panther Minerals Inc. (“Panther Minerals”) for two months beginning June 1rst 2024. The coverage includes, but is not limited to, digital and social media marketing, online advertisements, and content distribution about Panther Minerals. We (Omni8 communications Inc.) do not own shares of Panther Minerals. Because Panther Minerals has paid us for our online marketing and advertising services, and we (Omni8 Communications Inc.) are compensated by the Company, you must recognize the inherent conflict of interest involved that may influence our perspective of Panther Minerals. Because we are paid by Panther Minerals, and therefore we are not independent reporters, our coverage of Panther Minerals may highlight many of its positive aspects, and not necessarily the potential risks to its business or to investing in its stock.

Financial Gambits does not guarantee the accuracy or completeness of the information presented in the articles and interviews on this site. The opinions expressed are those of the authors and interviewees and do not necessarily reflect the views of Financial Gambits. The content provided is for informational purposes only and does not constitute investment advice. Readers are encouraged to conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

Our full disclaimer can be read here at https://financialgambits.com/disclaimer/