10 things to watch in the stock market Monday including Nvidia and geopolitics

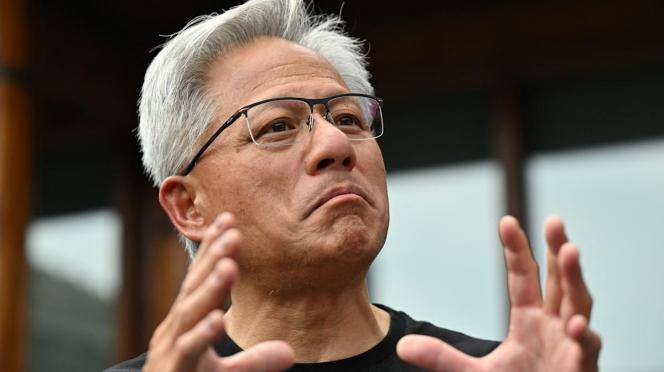

The Club’s 10 things to watch Monday, Aug. 18 — Today’s newsletter was written by Zev Fima, the Club’s portfolio analyst. 1. Stocks are poised to start the week a bit lower. Crypto is continuing to sell off, and the yield on the 10-year Treasury note is down slightly to 4.295%. Oil and gold slightly higher. The Fed’s Jackson Hole retreat and retail earnings are big events this week . 2. Geopolitics are also front and center. Ukranian President Volodymyr Zelenskyy is headed back to the White House today to discuss ending the war with Russia. Leaders from the U.K., France, Germany, Italy, Finland and the EU are also expected to be in attendance. President Donald Trump met with Russia’s Vladimir Putin on Friday. 3. Cantor Fitzgerald upped its price target on Club name Nvidia to $240 a share from $200 and reiterated its overweight buy rating. Analysts said with Blackwell fully ramping and demand for AI not letting up, estimates will need to go higher. China is potential upside too. Morgan Stanley was also positive on Nvidia this morning. 4. Club stock Home Depot’s price target at Stifel was raised to $432 from $425, and analysts reiterated their buy rating ahead of earnings tomorrow morning. While analysts said business trends in the second quarter were mixed, expectations for lower rates helped support the stock. 5. Roth Capital cut its price target on Coterra Energy to $27 from $32. It kept its buy rating on the stock, while downgrading a number of names in the energy complex, citing excess supply hurting natural gas prices. We exited Coterra last week, arguing you can’t outrun your commodities. 6. Club name Meta is expected to debut its “Hypernova” device next month, Bloomberg News reported. The device will feature smart-glasses capabilities, similar to the existing Meta Ray-Ban line, and a small display. Hypernova will start at less than $1,000 and is “a precursor to full-blown augmented reality glasses,” Bloomberg reported. 7. Lackluster sales of Apple’s Vision Pro due to its high price tag and a lack of compelling features were highlighted in the same Bloomberg story. Apple’s premium strategy works for iPhones because the smartphone market is much more mature than the one for headsets. The Club holding is expected to deliver a cheaper, lighter Vision Pro in 2027, which could help grow the market. 8. Barclays lower its Salesforce price target to $316 from $347. While analysts’ channel checks showed solid demand, AI remains a key source of concern among software investors. We recently discussed how AI adoption can reduce the need for individual software licenses. Activists may be looking at Club name Salesforce again. 9. Shares of beaten-up Novo Nordisk rose by 3% this morning on news that its GLP-1 obesity drug Wegovy received additional approval from U.S. regulators to treat a certain type of liver disease commonly called MASH. Club stock Eli Lilly is also studying its lead GLP-1 as a MASH treatment. 10. Another win for the nuclear cohort: Google and Kairos Power said today that the latter’s advanced nuclear plant will be hooked into the Tennessee Valley Authority’s electric grid by 2030. Plus, TVA has agreed to buy power from the reactor and the electricity will help power Google data centers in Tennessee and Alabama. Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free (See here for a full list of the stocks at Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.