What to watch this week

Stocks ended the week in rally mode after Federal Reserve Chair Jerome Powell opened the door for a September interest rate cut.

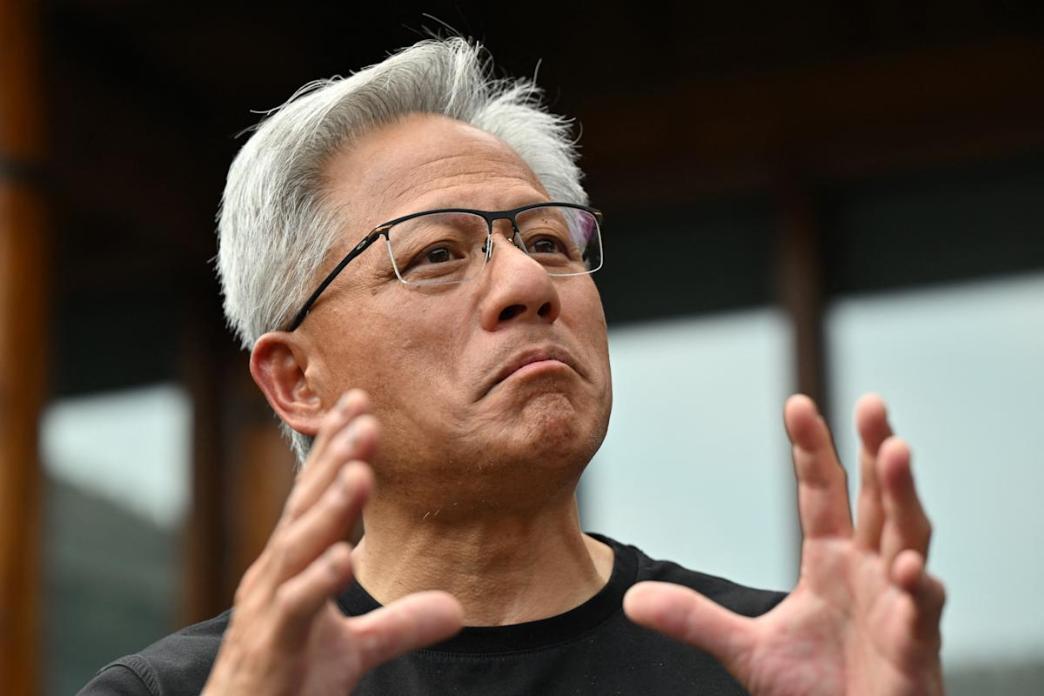

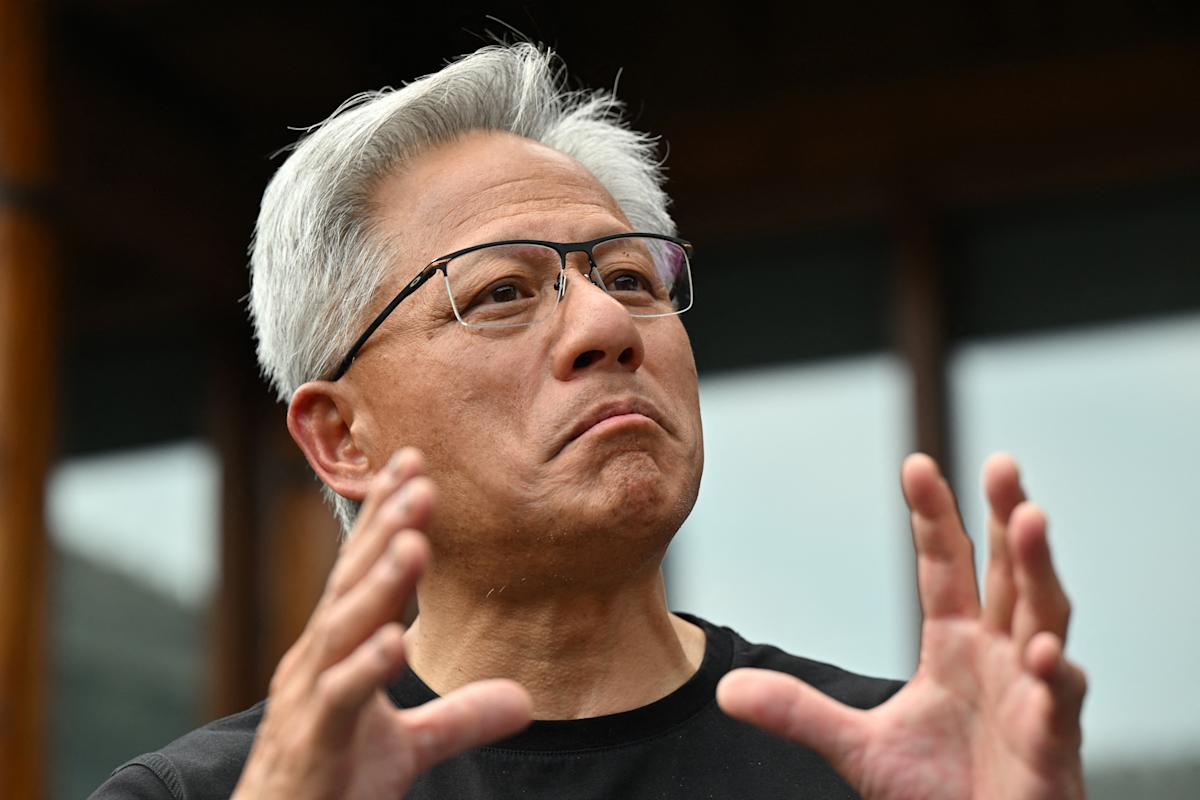

In the week ahead, earnings from Nvidia (NVDA) will see the world’s largest company and AI leader test a summer rally that has stocks back near record highs.

After slump earlier in the week, a massive surge following Powell’s comments in Jackson Hole left the Dow Jones Industrial Average (^DJI) at a record high and other indexes roaring. The S&P 500 (^GSPC) rose 0.3% on the week, while the Nasdaq Composite (^IXIC) slipped 0.5%. The Dow gained 1.5%.

Nvidia’s quarterly earnings release after the bell on Wednesday will be the week’s key event, with updates on inflation, GDP growth, home sales, and consumer sentiment featuring on an economic calendar that will be busier than the earnings calendar.

Outside of Nvidia, reports from Dell (DELL), Dick’s Sporting Goods (DKS), Best Buy (BBY), Dollar General (DG), and Abercrombie & Fitch (ANF) will serve as the corporate highlights.

During what was likely his final speech at the Jackson Hole Symposium as Fed chair, Jerome Powell told the audience the “shifting balance of risks may warrant adjusting our policy stance.” For investors, the words “may warrant” became a green light on rate cuts next month.

Markets rallied in kind.

In his speech, Powell highlighted that “downside risks to employment are rising,” while “a reasonable base case is that the effects [of tariffs on inflation] will be relatively short-lived.”

JPMorgan’s chief US economist, Michael Feroli, told clients in a note on Friday Powell’s comments indicated the “door to a September cut opened wider.” And market pricing suggested as much — investors were placing 85% odds on Friday that Fed will cut interest rates by a quarter of a percentage point at its September meeting, per the CME FedWatch Tool.

These rate cut hopes will be put to the test on Friday with the release of the Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation measure.

Economists expect annual “core” PCE — which excludes the volatile categories of food and energy — to have clocked in at 2.9% in July, up from the 2.8% seen in June. This would mark the highest annual increase since February. Over the prior month, economists project “core” PCE at 0.3%, unchanged from June.

“Tariff-related price pressures are broadening across the goods sector and appear to be spilling over into the services sector,” wrote economists at Wells Fargo in a note.

“We ultimately expect core PCE inflation to peak slightly above 3% by the end of the year. With inflation drifting in the wrong direction and the labor market losing momentum, the Federal Reserve faces difficult trade-offs in balancing its dual mandate.”

The largest stock in the market is slated to report quarterly results after the bell on Wednesday.

Wall Street expects Nvidia to report earnings per share of $1.01 on revenue of $46.13 billion. A slew of Wall Street analysts have raised their price targets on Nvidia leading into the release, but at least one of those analysts warned the quarter may not impress to the level investors have become accustomed to over the past several years.

“We expect NVDA to report strong [second quarter] results and guide [third quarter] slightly below consensus, as we expect NVDA’s outlook to exclude direct revenue from China given pending license approvals and uncertainty on timing,” Keybanc analyst John Vinh wrote in a note to clients on Aug. 19.

Still, Vinh boosted his price target on the AI chip leader to $215 from $190, as he expects Nvidia’s outlook to improve into next year.

Nvidia shares entering the release are up 32% this year and have nearly doubled since the market bottom in April.

Nvidia’s earnings release comes at a precarious moment for the broader AI trade, which, outside of Friday’s all-encompassing rally, has largely hit pause over the past few weeks.

So far in August, the Information Technology sector (XLK) has been the worst performer in the S&P 500.

Citi’s head of trading strategy, Stuart Kaiser, wrote in a note to clients on Aug. 20 that he expects “sentiment selling” in the tech and AI trade to clear quickly unless Nvidia “posts a large disappointment.” In other words, Kaiser sees the tech trade picking back up that started Friday as likely to continue.

As tech has taken a back seat, some of this year’s laggards have become the leaders.

As markets believe the Fed is inching closer to cutting rates, interest rate-sensitive areas of the market have soared higher. The small-cap Russell 2000 (^RUT) index is up 5% over the past month, while the SPDR S&P Homebuilders ETF (XHB) is up over 10%. In that same time period, the S&P 500 is up just 2.6%.

“We’ve changed back to a market condition that is more about rotation than the outright risk aversion,” Interactive Brokers chief strategist Steve Sosnick wrote in a note on Aug. 20.

Economic data: Chicago Fed activity index, July (-0.10 prior); New home sales, month-over-month, July (+0.1% expected, +0.6% prior); Dallas Fed manufacturing activity, August (+0.9 prior); New home sales, month over month, July (+0.1% expected, +0.6% prior)

Earnings: No notable earnings.

Economic data: FHFA house price index, month over month, June (-0.2% prior); S&P CoreLogic Case-Shiller 20-City, year over year, non-seasonally adjusted (+2.8% prior); Conference Board Consumer Confidence, August (96.4 expected, 97.2 prior); Richmond Fed manufacturing index, August (-20 prior)

Earnings: BMO (BMO), MongoDB (MDB), Okta (OKTA), PVH (PVH)

Economic data: MBA Mortgage Applications, week ending Aug. 22 (-1.4% prior)

Earnings: Nvidia (NVDA), Abercrombie & Fitch (ANF), CrowdStrike (CRWD), Five Below (FIVE), HP (HP), Kohl’s (KSS), Pure Storage (PSTG), Snowflake (SNOW), The J.M. Smucker Company (SJM), Urban Outfitters (URBN), Williams-Sonoma (WSM)

Thursday

Economic data: Second quarter GDP, second estimate (+3.1% annualized rate expected, +3% prior); Second quarter personal consumption, second estimate (+1.4% previously); Initial jobless claims, week ended Aug. 23 (235,000 prior); Pending home sales, month over month, July (+0.2% expected, -0.8% prior)

Earnings: Affirm (AFRM), Best Buy (BBY), Bath & Body Works (BBWI), Dick’s Sporting Goods (DKS), Dell (DELL), Dollar General (DG), Gap (GAP), Marvell (MRVL), Petco (WOOF), TD Bank (TD), Ulta (ULTA)

Economic data: PCE inflation, month over month, July (+0.2% expected, +0.3% prior); PCE inflation, year over year, July (+2.6% expected, +2.6% previously); “Core” PCE, month over month, July (+0.3% expected, +0.3% prior); “Core” PCE, year over year, July (+2.9% expected; +2.8% prior); University of Michigan consumer sentiment, August final reading (58.6 expected, 58.6 prior); wholesale inventories, month-over-month, July preliminary (+0.1% prior); MNI Chicago PMI, August (45.2 prior, 47.1 expected)

Earnings: Alibaba (BABA)

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance