China’s metal markets are in the grip of a speculative frenzy, with trading values in Shanghai surging more than 260% from a year earlier, as traders and deep-pocketed funds pile into commodities like copper, nickel and lithium.

Open interest has surged to a record across the six base metals traded in Shanghai, pointing to robust sentiment as investors bet on global supply tightness, resilient industrial demand and a more supportive interest-rate backdrop in China and the US. Heightened geopolitical risks have added to the rush into raw materials.

The total turnover of the Shanghai Futures Exchange’s six base metals contracts, plus gold and silver futures, reached 37.1 trillion yuan in December – equivalent to more than $5 trillion. By trading volume, Dec. 29 was the single busiest day for copper in more than a decade.

As well as general supply tightness, metals are finding support from monetary easing by central banks. Lower interest rates typically encourage investors to buy non-yielding assets like metals. A weaker dollar is also a tailwind, with investors piling into the so-called debasement trade.

“We’ve seen significant macro allocation flows into commodities,” said Jia Zheng, head of trading at Shanghai Soochow Jiuying Investment Management Co., adding that some equity funds are betting commodity futures will rise alongside stocks this year.

Nickel – used in stainless steel and batteries – advanced nearly 6% on the Shanghai Futures Exchange on Wednesday. The most-active aluminum contract closed at its highest since 2021, while copper has shot beyond a milestone 100,000 yuan a ton, defying some bearish signs in the local market including rising inventories.

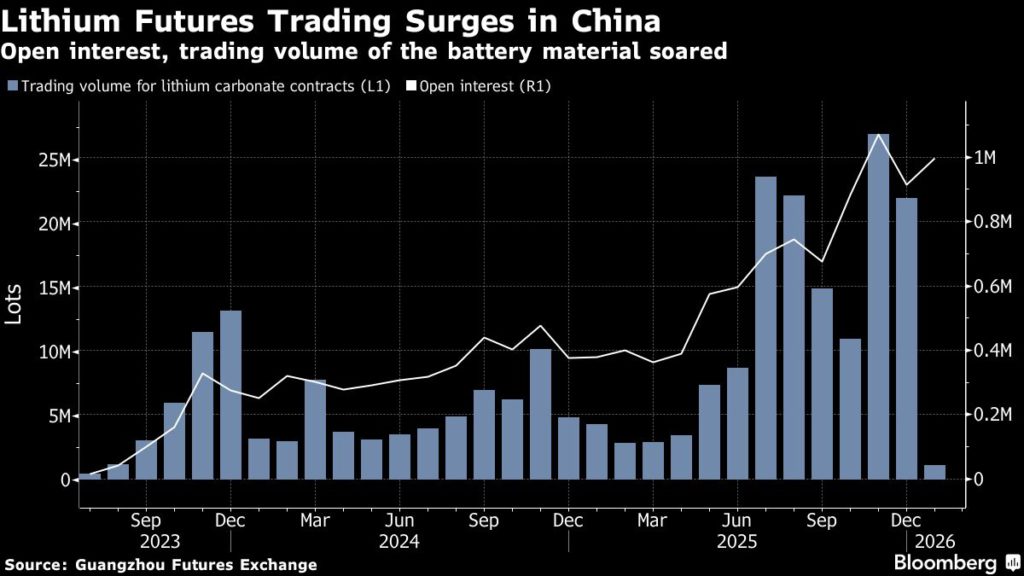

Turnover on the Guangzhou Futures Exchange — including lithium, palladium, platinum and silicon futures — was around 5.6 trillion yuan in December. This was more than six times higher than the same month in 2024, although some of the Guangzhou contracts are relatively new.

But questions remain as to whether the scorching rallies have run too far, too fast. As the bull run accelerated in the second half of last year, some of the new capital invested was speculative, said Chi Kai, chief investment officer at Shanghai Cosine Capital Management Partnership.

“This market will test trading skills,” he said. “Easy profits won’t come simply by holding positions – and the risks are increasing.”

Volatility is becoming an increasing risk, especially in Guangzhou, where a platinum contract launched at the end of November has already traded either limit-up or limit-down on eight occasions.

From mid-December, the Guangzhou bourse also capped new positions and raised fees for lithium carbonate after the contract rallied 35% in the space of around seven weeks. Though open interest has retreated since then, it remains at a historically elevated level. The most-active lithium futures contract rose 4.5% on Wednesday.

The Shanghai Futures Exchange will also raise the trading margin and daily price limit for some silver futures from Friday, according to a statement from the exchange. The bourse urged investors in a separate statement to invest rationally, citing recent developments that have caused volatility in metal prices.

With base metals starting the year strongly — copper hit a record on the London Metal Exchange earlier this week and the LMEX Index that tracks the six main metals surged to the highest level since 2022 — Chinese investors are likely to stick around. This is reinforced by the presence of macro funds, which tend to hold their positions longer, Shanghai Soochow’s Jia said.

“Looking ahead to the next six months, under the broad backdrop of monetary easing in China and the US, macro capital is unlikely to exit,” she said.

Read More: US tariff pull on copper drains China’s bonded warehouses