Table of Contents Show

CEO Greg Beischer joins me for an update interview on some busy news flow and talks about why Canwell could be so important to AEMC.

1. Interview

2. Companion Article

I last spoke to Greg in late October with our introductory interview. And though it has only been 3 months, AEMC has certainly gathered no moss, with a whole host of positive news releases on a variety of fronts. And yet, despite objectively strong news coming seemingly every couple weeks, the share price has struggled to keep up. Below I thought I would do a quick overview of the good and the bad for AEMC over the past 3 months to complement my discussion with Greg.

The Good

Some obvious answers here, mainly around drill results and resource estimates.

- Drill ResultsAEMC has produced some impressive assays over the winter, with “300 meters of 0.33% NiEq” (give or take) pretty much being repeated with every one of its drill holes. And just for the sake of comparison, 0.3% Ni comes out to about 0.74g Au at current spot prices. Not too shabby I would say.Greg liked this project because it was so derisked from historical exploration and I give him credit – he called his shot. No unpleasant surprises. Just nice, consistent Ni mineralisation with a healthy enough polymetallic kicker to make you think the economics of this project will inevitably be pretty darn good if the met work cooperates.

- The Resource Estimate.Based only off historical work, getting to 2.1 billion pounds of NiEq (with about 3/4 of that coming from nickel itself) is pretty impressive. The fact that it comes from such a small area compared to how much high-confidence mineralisation is still out there waiting to be drilled out and proved up means there remains a lot of blue sky potential. In the interview, Greg figures they can double their “pounds in the ground” during their 2024 drill campaign, and believes they’re on track to get up to even 7 billion pounds when all is said and done.AEMC is also applying what I take to be a fair recovery rate for its project: 60% for Ni and a flat 50% across the board for everything else. These polymetallic deposits can get a bit messy/expensive if you try to squeeze the last drop of blood from the stone. Luckily for AEMC, when you have a plentiful deposit like, say, billions of pounds of nickel in the ground, you can afford to do things cheaply to support your economic valuation, even if it means leaving meat on the bone.

- Progressing Canwell to Drill-Ready

The focus of the second half of the interview was the Canwell property as I believe it is potentially extremely significant. The remarkably consistent grades at Eureka makes for easy mine designs in terms of choosing where to mine and when. But the downside is that there is no obvious place to begin production to maximise the speed of your returns. The only thing missing from Eureka is a high-grade deposit somewhere to goose those headline economic numbers and make your NPV, IRR, and payback periods more attractive. Imagine a 30+ year mine that could get all its initial capital out within the first 3 or 4 years. That’s obviously a pretty powerful combination.

That’s why I am particularly excited to see what comes out of the ground at their Canwell property. If they can hit high-grade over decent lengths there, that could honest potentially transform the whole company and lead to one of those violent, north-bound rerates everyone in this industry dreams of getting in on.

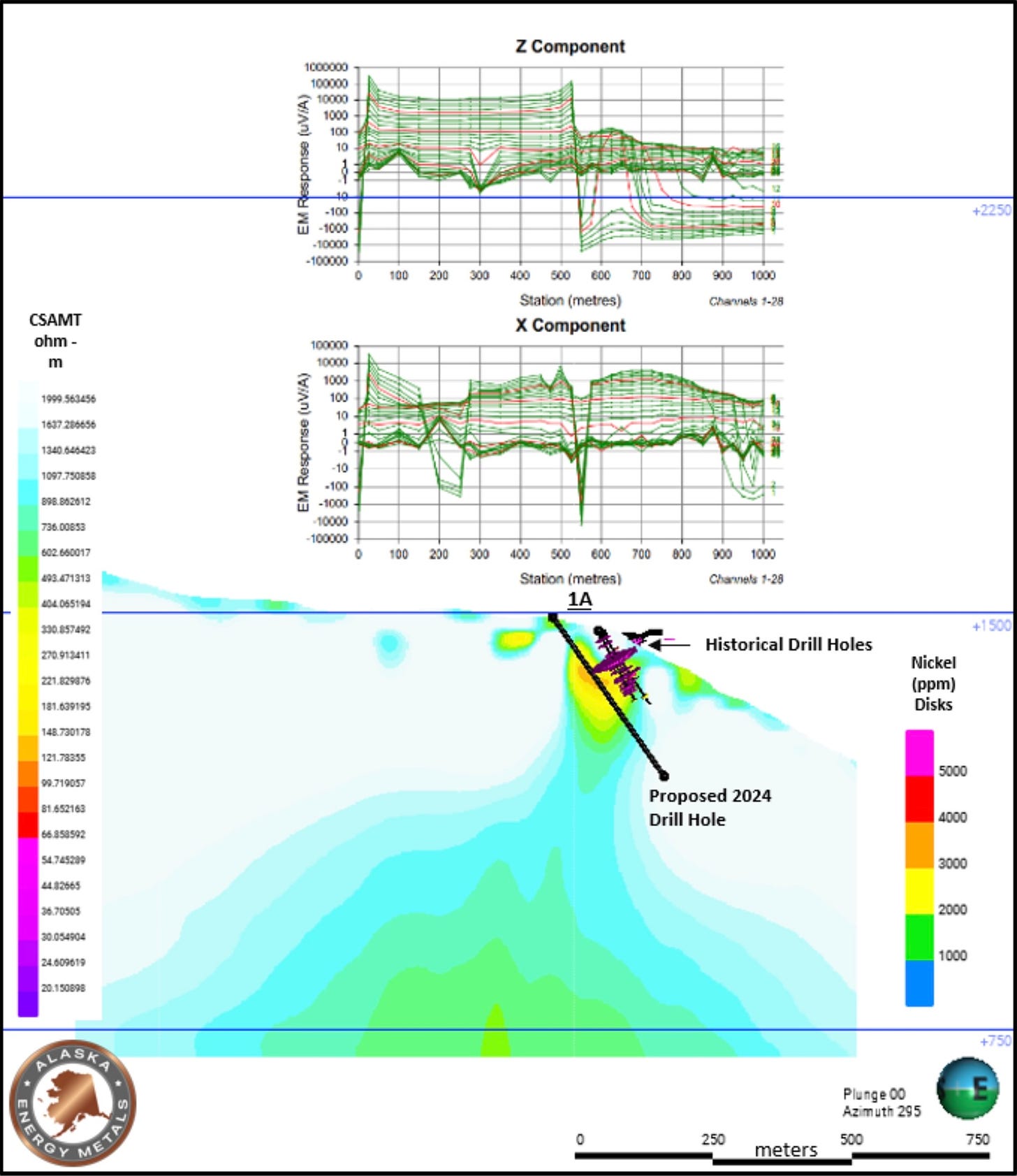

As Greg gets into in his mini geophys lecture, nickel is comparatively easy to search for as it is magnetic and conductive. Two things you can identify from surface. Using modern geophysical technology has given AEMC better, deeper, below ground data. Allowing them to see targets missed by earlier shallow drilling. See below for a CSAMT reading and interpretation of one of the prospects.

While the main game remains at Eureka on the march to 7 billion pounds, if AEMC can come good at Canwell, that could be arguably just as defining for this project as the original Eureka resource.

The Bad

- The Share Price

So with all this positive news flow, and such a positive future, why is the share price struggling to find its feet? The answer, at least from what I can tell, is a classic one: Financing paper coming free-trading. Take a look at AEMC’s chart. From May-November it is decently healthy with some definite upward trajectory. And then, the bottom just fell out as December rolled around. My suspicion? A $3 million/7.4 million share financing that closed in August came free trading 4 months later and the results seem to quite clearly speak for themselves.

Since then, the share price has seemed glued to 40 cents. Care to take a guess at the price of the financing? From my perspective it seems clear those 7.4 million 40 cent shares have very successfully kept a lid on the share price ever since. Which is maybe a good thing if you’re still trying to build a position but not so good if you were already in.

Since those 7.4 million shares came free trading, total volume (napkin math here) for AEMC is about 4.5-5 million on the main Venture exchange. Which is to say the days spent at these levels is likely coming to an end very soon. I think this project is too strong and too well publicised to stay down at these levels much longer. As those shares dry up, price discovery is going to push this thing northward again (macro markets permitting of course).

Ultimately though, even with the frustrating share price, the past 3 months have been a resounding success for AEMC as I cover in greater detail with Greg in our discussion. Free trading paper pressure is temporary. Rapidly proving up 7 billion pounds of nickel is not. You just have to hope that AEMC can get stickier hands involved in the next financing so the cycle doesn’t start all over again. But cream eventually rises to the top, and I believe it is just a matter of time for AEMC to start grinding north to a more just valuation for what it has got going on.

3. Summary and Transcript

Click here for a link to the transcript.

Timestamps are hyperlinks to the interview.

01:00 Headlines Discussion – Drilling Results. Were there ever any concerns?

- The interview focuses on recent developments since October, including numerous news releases and advancements.

- Key topics include a mineral resource estimate, the sale of information to KoBold, and above-ground work at the Canwell property.

- Beischer notes the geological stability and predictability of the Eureka Zone, emphasizing its homogeneity and large scale.

- The potential for big mining companies to take interest in the project is discussed due to its predictability and scale.

04:00 Maiden Resource Estimate

- The company’s mineral resource estimates are mentioned, including large quantities of nickel and other metals.

- Beischer anticipates a significant increase in the resource estimate following recent drillings.

09:30 When will the next drill campaign begin

- Plans for future drill campaigns are outlined, with expectations of substantially increasing the mineral deposit estimate with a 3-4 rig, 15,000+m drill campaign.

- The company’s strategy includes extensive geophysical surveys and data analysis to identify high-potential drilling areas.

10:20 Mark Begitch Board Appointment

- The appointment of Mark Begich to the board of directors is discussed, highlighting his experience in Alaskan politics and resource development.

12:30 KoBold Data Sale and Company Discussion

- Beischer describes the company’s collaborative relationship with KoBold, a neighboring exploration company.

16:00 Canwell Property Intro

- Focus shifts to the Canwell property, described as a potential high-grade starter zone that could significantly improve project economics.

18:55 How deep was historical exploration and how deep do you plan to go and geophysics discussion

- Beischer shares visuals and discusses geophysical surveys and drill targets at Canwell.

- The company aims to drill deep holes at Canwell in 2024, expecting to find high-grade nickel and copper sulfides.

27:00 Final Thoughts

- The company’s marketing efforts aim to attract a younger generation of investors interested in raw materials and exploration investments.

28:20 Vancouver Conference Season

- The interview concludes with plans to attend the Metal Investors Forum and VRIC in Vancouver, as part of the company’s ongoing marketing and investor outreach efforts.

This is a strong company. Greg Beischer strikes me as a capable CEO. They catch some raised eyebrows due to a very substantial marketing budget (of which I took a piece, mind you) but this isn’t a puff company with some moose track land they’re looking to pump and dump. Greg obviously wants to get this thing to maximum size and execute on his plan rapidly. And I think the logic of having a large, high-confidence project that can be rapidly expanded in size and wanting to pair it with an aggressive marketing campaign is fairly reasonable. With the resource they’ve got in hand and the critical mineral tailwinds in America starting to blow, I think AEMC has strong odds to come good on their efforts to create meaningful investor returns.

Thanks for reading.

-Matthew from JRI

Article Original Posted: Junior Resource Investing