It’s important to take a long-term view when making investment decisions.

The S&P 500 (^GSPC 0.90%) has gained more than 20% so far this year as this bull market charges ahead. Though there have been some pullbacks along the way, the general mood among investors has been positive as they anticipated the lowering of interest rates and rushed to get in on high-growth artificial intelligence (AI) stocks. In fact, AI stocks have led this entire movement, climbing by double- and triple-digit percentages since the start of 2024. Other growth stocks took off, too, as investors bet on better times ahead.

This, of course, has translated into gains for many investors’ portfolios. But there’s one negative element that comes along with that type of growth: Stocks today are generally a lot more expensive by the common valuation metrics than they were earlier this year, meaning that if you buy now, you’ll be getting less of a bargain. Considering this, should you really buy stocks today?

Image source: Getty Images.

Companies powering today’s economy

First, let’s take a look at the average valuations of stocks in the S&P 500 — a good reference point, as the benchmark index includes the companies responsible for the majority of the value in U.S. stock market. The most useful valuation measures — which determine whether a stock is cheap or expensive — generally look at a company’s earnings (past or projected) in relation to its current stock price.

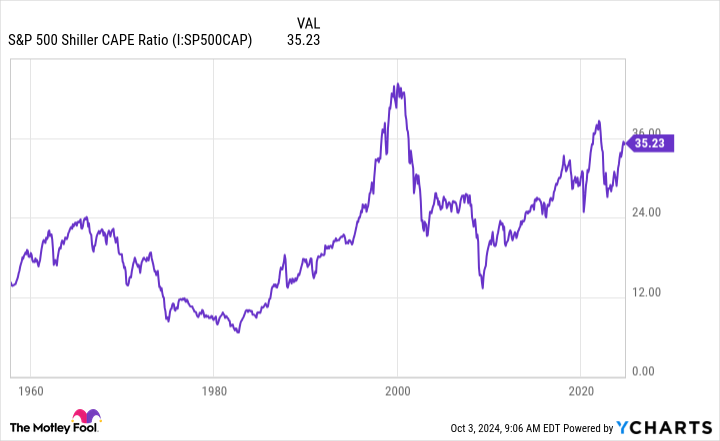

To get the clearest picture, though, I suggest using the S&P 500 Shiller CAPE ratio, because it measures a stock’s price against the company’s inflation-adjusted earnings over a 10-year period to truly capture that company’s long-term performance. (CAPE stands for “Cyclically Adjusted Price-to-Earnings.” )

Now, we’ll look at S&P 500’s valuation levels by this metric during today’s bull market compared to its valuations during the past 10 bull markets, dating back to 1957. The measure sits at about 35 today, and the chart shows that U.S. large-cap stocks were more expensive during only two other periods during that 67-year span.

S&P 500 Shiller CAPE Ratio data by YCharts.

Notably, over the past 20 years, the average reading on this metric was in the mid-20s.

So stocks are pretty richly valued right now, at least compared to historic levels. Now, let’s get back to our question. Should you really buy stocks in such an environment? After all, stocks at these levels could suggest a correction ahead — and on top of this, it’s generally preferable to pay fair prices for stocks rather than top dollar.

You can still find bargains…

Before throwing in the towel — even temporarily — on investing, keep a couple of things in mind. First, just because the market in general is expensive doesn’t mean every stock is. For example, trading at 10 times forward earnings estimates, healthcare giant Pfizer looks like a bargain today. So does e-commerce company Etsy, trading at 11 times forward earnings estimates.

When investing, it’s key to stay in the market throughout various cycles and to look at stocks individually — that way, you won’t miss out on opportunities.

Second, even if the market does pull back at some point, and a stock you’ve just bought declines, that shouldn’t spell disaster for your portfolio if you invest for the long term. Short-term gains or losses won’t make much of a difference to your overall returns if you hold on for five or 10 years or more — and a long-term strategy means you’ll have plenty of time to benefit from a company’s growth over time.

Of course, considering the S&P 500 Shiller CAPE ratio, you’ll want to remain vigilant as you consider which stocks to buy right now. Quality companies that have become too pricey may be ones to add to your watch list, in hopes that you’ll be able to catch them at some point in the future when their valuations look more reasonable. Meanwhile, continue investing, because it’s not the entire market that’s overpriced. There are great opportunities out there waiting for you, and the earlier you get in on these stories, the more you’ll benefit as they progress over time.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Etsy and Pfizer. The Motley Fool has a disclosure policy.