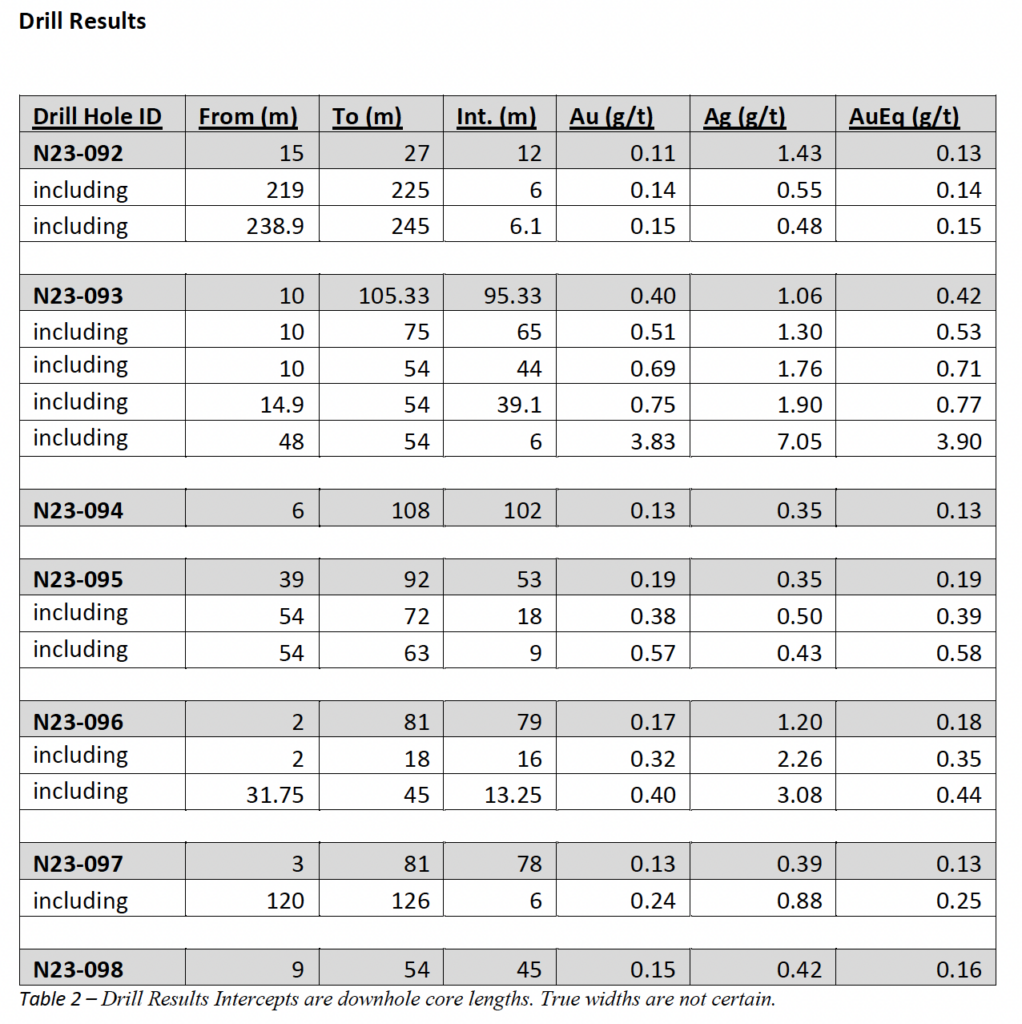

CARLYLE COMMODITIES CORP. (CSE:CCC, FSE:BJ4, OTC:CCCFF) (“Carlyle” or the “Company”)is pleased to announce results from its most recent diamond drill program at the Newton Gold & Silver Project. The drill program completed 840 metres of drilling across 7 (seven) drill holes, and tested multiple high priority targets with aims of increasing both tonnage and ounces of gold and silver in the Company’s current National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Newton Project Inferred Resource Calculation.

Highlights

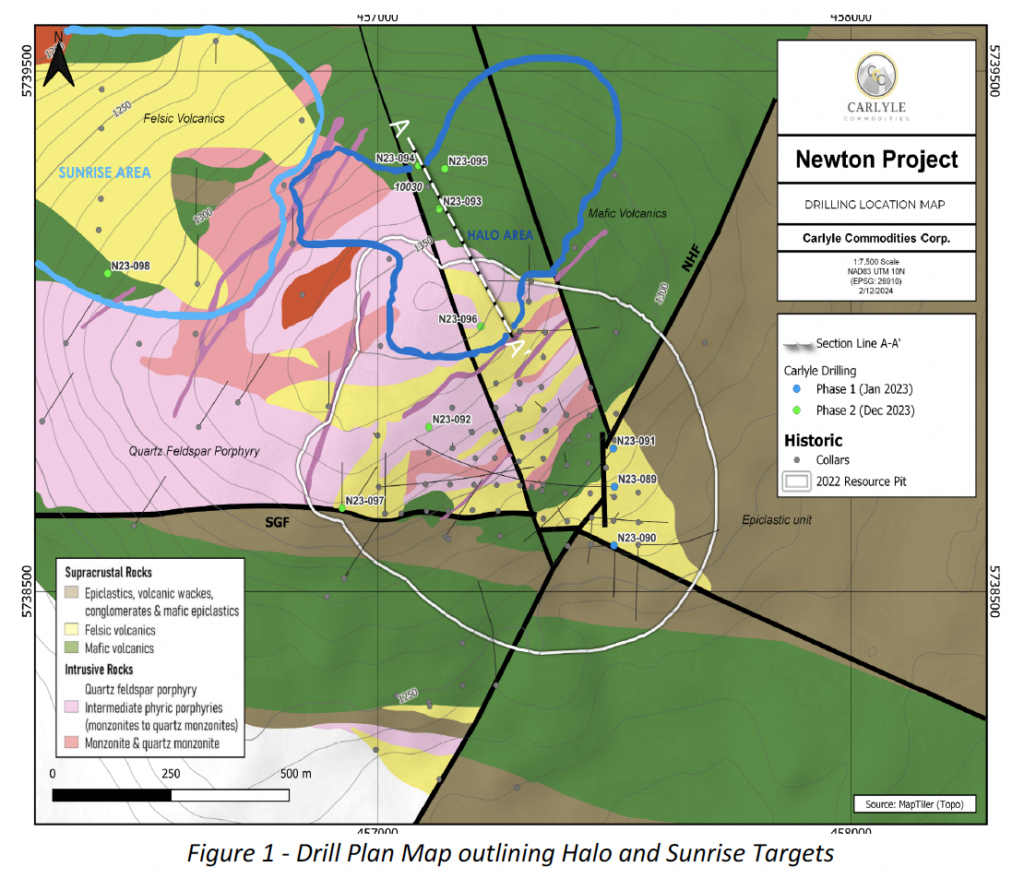

- The Company has confirmed a new, near surface, higher grade gold and silver bearing zone to the north of the current inferred mineral resource, which the Company now calls the Halo area and which remains open in multiple directions.

- Gold and silver mineralization was confirmed present in another farther north-western area, which the Company now calls the Sunrise area.

- All holes encountered gold and silver mineralization.

About the Halo Area

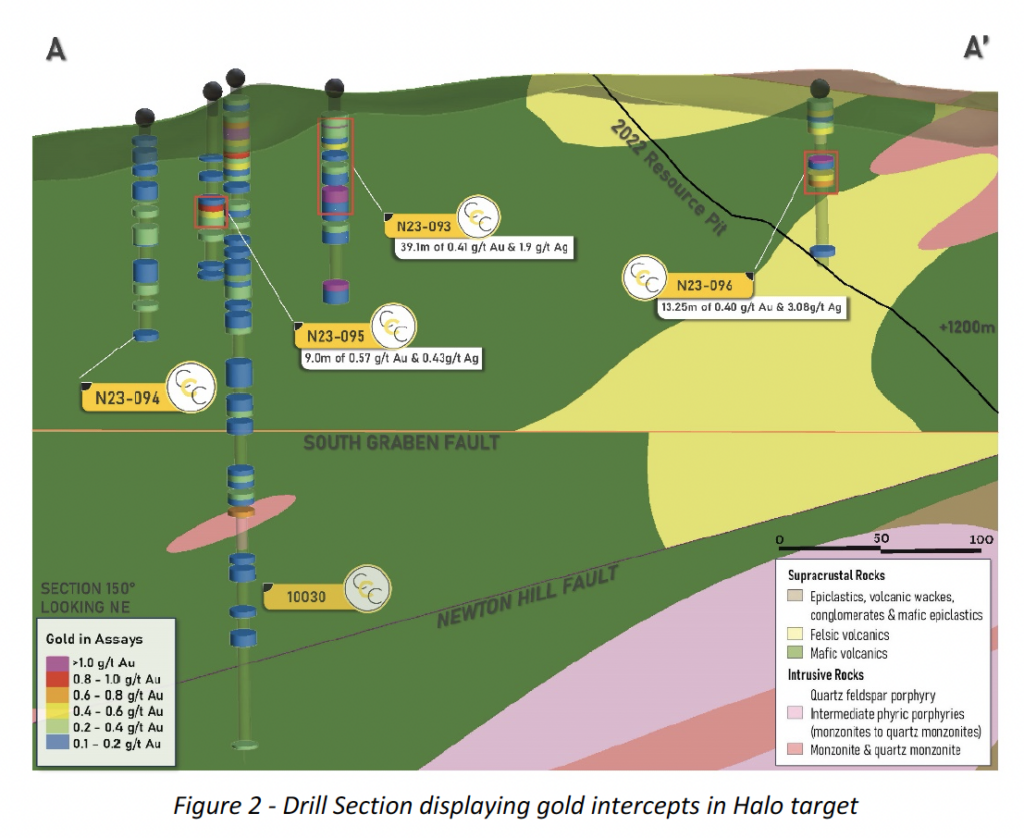

Historical hole 10030, located approximately 400 metres north of the current inferred mineral resource intersected 24 metres of 0.83 g/t Au from 18.0 – 42.0 metres in propylitic altered mafic volcanics associated with an IP chargeability anomaly but was never followed up on until this current phase of work.

The Company drilled three shallow holes around 10030, being holes N23-093, 94, and 95, triangulating 50 metre step outs to the northeast, southwest and northwest of hole 10030 to investigate possible continuation of this mineralization. These holes were also plotted based on gold-in-soil geochemical anomalies and elevated IP chargeability anomalies proximal to hole 10030.

To the southeast of 10030, hole N23-093 intersected 0.75 g/t gold over 39 metres, starting at 14.9 metres. This hole confirms the continuation of a higher grade, near surface zone that appears to be widening towards the current inferred mineral resource and remains open in multiple directions. Further drilling is required to continue defining the size of this mineralized area, integrate this discovery into the Company’s inferred resource calculation, and evaluate its potential as a possible future starter pit.

Mineralization also continued to the northeast of 10030, highlighted by 18 meters of 0.38 g/t gold in N23-095 starting at 54 metres. Mineralization continued to the northwest of 10030 as well, where N23-094 cut propylitic altered mafic volcanics returning 102 metres of 0.13 g/t gold from 6 metres. The stronger mineralized vectors of the Halo area currently remain open to the west, northeast, east, south and southeast.

Meanwhile, more than 200 meters south of 10030, hole N23-096 was drilled between the Halo area and the current inferred mineral resource, cutting 13.25 metres of 0.40 g/t gold from 31.75 metres, within mafic volcanics. The top of the hole intersected very strongly altered felsic volcanics with disseminated and fracture controlled sulphides to a depth of 24 metres and returned 0.32 g/t gold from 2-18 metres. This suggests a possible continuation of the newly confirmed northern system this far south.

The Company’s intention is to continue drilling in all open directions of this newly confirmed area to further define its ultimate size, grade, and potential.

About the Sunrise Area

Hole N23-098 was a short 54 metre exploration hole drilled more than 700 metres northwest of the current inferred mineral resource in the Sunrise target area and returned 0.15 g/t gold from 9 to 54m. The Sunrise target is a broad area with elevated gold in soil and chargeability anomalies that correlate with historical drill logs indicating the presence of untested felsic volcanics. Hole N23-098 tested a peripheral area of this broad target and successfully confirmed elevated gold in the strongly altered felsic intrusive increasing its clear interest for Carlyle, thus warranting further investigation.

Other Holes

Hole N23-097 was collared west of the current inferred mineral resource and intercepted elevated gold values including 0.13 AuEq from 2-81 metres.

Management Comments

Mr. Morgan Good, President and Chief Executive Officer stated: “After a smooth and productive Phase 2 drill program Carlyle learned many new technical factors including adding two key zones to the property. Of main interest after this program is the triangular testing around historical hole 10030 which is located approximately 400 metres north of the current inferred mineral resource having intersected 24 metres of 0.83 g/t Au from 18.0 – 42.0 metres. To the southeast of 10030, hole N23-093 intersected 0.75 g/t gold over 39 metres, starting at 14.9 metres. Combining this result with historical higher-grade near surface drilling adds more clues and gives the Company optimism that this ‘Halo’ Area could be one of the keys we are seeking and definitely warrants follow-up work as soon as possible.”

Mr. Jeremy Hanson, VP Exploration stated: “We are very pleased with these results. We have confirmed a new near surface target immediately north of the current inferred mineral resource, the ‘Halo Area’; we believe there is potential to tie this target into the current known mineralization, and the fact that it is hosted in a separate lithology now adds additional theories and targets for mineralization. We also confirmed that the northwest ‘Sunrise’ target is bordered by strongly altered felsic intrusives enriched with gold, which we believe increases the prospectivity of the area.“

Quality Assurance/Quality Control (QA/QC)

Carlyle Commodities has applied a rigorous quality assurance/quality control program at the Newton Project using best industry practice. All core was logged by a geoscientist. The Newton drill core was drilled at NQ diameter. The drill core was split in half using a core saw and each sample half was placed in a marked sample bag with corresponding sample tag then sealed. The remaining half core is retained in core boxes that are stored in a secure facility. The chain of custody of samples was recorded and maintained for all samples from the drill to the laboratory.

All diamond drilling sample batches included 5% QA/QC samples consisting of certified blanks, standards and field duplicates. Multiple certified ore assay laboratory standards and one blank standard were used in the process. Samples were submitted to Bureau Veritas British Columbia, an independent ISO 9001: 2008 certified lab, for gold, silver and base metal analysis using Inductivity Coupled Plasma (ICP), and Fire Assay (FA) methods.

Samples were prepared by crushing the entire sample to 75% passing 2mm, riffle splitting 250g and pulverizing the split to better than 85% passing 75 microns. Gold was analyzed using a 30-gram fire assay and ICP-AES. The performance on the blind standards, blanks and duplicates achieved high levels of accuracy and reproducibility and has been verified by Jeremy Hanson, a qualified person as defined by NI-43-101.

Qualified Person

Jeremy Hanson, P.Geo. a Qualified Person, as such term is defined by NI 43-101, has reviewed the scientific and technical information that forms the basis for this news release and has approved the disclosure herein. Historical information contained in this news release cannot be relied upon. Mr. Hanson has not prepared nor verified the historical information and such information is not indicative of the mineralization of the Company’s Newton Project.

About the Newton Project

The Newton Project is a 100% owned Gold and Silver Project near Williams Lake, British Columbia. The Newton Gold Silver project is a low sulphide epithermal system. The system remains open in multiple directions, within a highly prospective land package that is workable year round. The inferred mineral resource estimate respectively contains 861,400 t. oz of Au, and 4,678,000 t. oz of Ag with an average grade of 0.63 g/t Au, a cut-off of 0.25 g/t Au throughout 42,396,600 tonnes (see June 14, 2022 news release for additional information).

A copy of Carlyle’s NI 43-101 compliant “Technical Report on the Updated Mineral Resources Estimate for the Newton Project, British Columbia, Canada” dated June 13, 2022 authored by Michael F. O’Brien, P.Geo., and Douglas Turnbull, P.Geo., which contains the Updated Newton Resource Calculation, is available under Carlyle’s profile on SEDAR+.

About Carlyle

Carlyle is a mineral exploration company focused on the acquisition, exploration, and development of mineral resource properties. Carlyle owns 100% of the Newton Project in the Clinton Mining Division of B.C. and is listed on the CSE under the symbol “CCC”.

ON BEHALF OF THE BOARD OF DIRECTORS OF

CARLYLE COMMODITIES CORP.

“Morgan Good”

Morgan Good

President and Chief Executive Officer

For more information regarding this news release, please contact:

Morgan Good, CEO and Director

T: 604-715-4751

E: morgan@carlylecommodities.com

W: www.carlylecommodities.com

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance, including without limitation, statements that a higher grade, near surface zone appears to be widening towards the current inferred mineral resource; and statements regarding the potential inferences that can be drawn from the Company’s recent drilling results; the Company’s intention to continue drilling in all open directions of the newly confirmed area to further define its ultimate size, grade, and potential; the Company’s belief that the Halo Area has potential to tie into the current known mineralization and the fact that it adds additional theories and targets for mineralization; and the increase in the prospectivity of the area around the Sunrise target are forward-looking statements and contain forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should” or “would” or occur. Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this press release, including that management’s hypothesis for mineralization on the project proves correct; that further drilling will improve the Company’s current inferred mineral resource estimate as anticipated; that the Company will have all the resources required to continue drilling and carrying out its business plans as anticipated; that the drill results from the phase 2 program accurately support management hypothesis and expectations regarding future results; and that the Company will not run into regulatory or other barriers in carrying out its exploration plans. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important factors that may cause actual results to vary, include, without limitation: that future drilling results will not improve the Company’s current inferred mineral resource estimate as anticipated or at all; that managements hypotheses for mineralization on the project is incorrect; general business, economic and social uncertainties; unanticipated costs; loss of key personnel; lack of capital to support the Company’s exploration plans; litigation, legislative, environmental, and other judicial, regulatory, political, and competitive developments; and other risks outside of the Company’s control. Further, labour shortages, high energy costs, inflationary pressures, rising interest rates, the global financial climate and the conflict in Ukraine and surrounding regions are some additional factors that are affecting current economic conditions and increasing economic uncertainty, which may impact the Company’s operating performance, financial position and future prospects. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. These forward-looking statements are made as of the date of this news release and, unless required by applicable law, the Company assumes no obligation to update these forward-looking statements.

Neither the CSE nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.