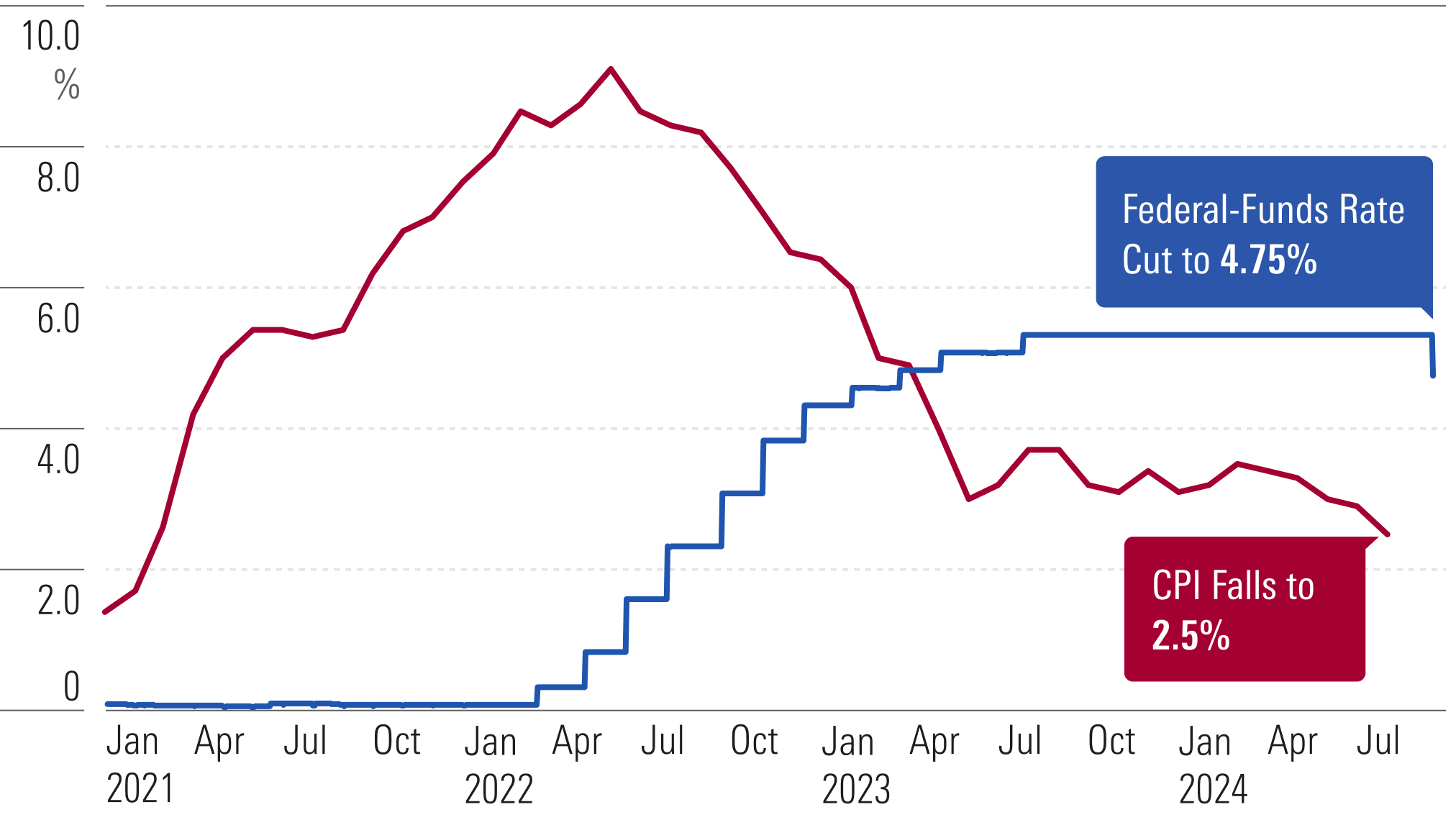

The Federal Reserve announced on Wednesday that it will lower its benchmark interest rate to a target range between 4.75% and 5.00%. That represents a half percentage point from the previous range of between 5.25% and 5.50%. The cut came after weeks of speculation whether the central bank would choose to reduce rates aggressively or opt for a smaller adjustment with a 25-basis-point reduction.

“The Fed’s decision today implies that the main battle against high inflation has been won, and all that’s left is a mopping-up operation,” says Preston Caldwell, senior US economist at Morningstar.

After slashing rates to rock-bottom levels to stimulate the economy during the early days of the covid-19 pandemic, the Fed embarked on an aggressive policy tightening cycle in March 2022 to combat runaway inflation. After 11 rate hikes, the central bank kept rates at their previous high for more than a year.

With Inflation Improving, Fed Lowers Interest Rates Half Percentage Point

In its statement on Wednesday, the Federal Open Market Committee said that it has “gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.” It also acknowledged that, while the jobs market has cooled, “economic activity continues to expand at a solid pace.”

Wednesday’s rate cut was widely expected, but only after months of uncertainty thanks to mixed economic data. While inflation has cooled dramatically since reaching 40-year highs in the summer of 2022, the Fed remained adamant that it would not loosen policy until it gained confidence that overly hot price pressures were well and truly fading. In July, inflation as measured by the Personal Consumption Expenditures Price Index—the Fed’s preferred gauge—came in at 2.5%, not far from the Fed’s long-run 2% target.

Fed Shifting Focus to Supporting Growth

The Fed “may now be shifting their focus to avoid causing economic stress by keeping rates too high for too long – in other words, they want to preserve the likelihood of achieving their desired soft-landing,” says Dominic J. Pappalardo, chief multi-asset strategist at Morningstar Investment Management. “Recent economic data suggests the economy is still relatively strong compared to other easing periods with unemployment at 4.2%, higher year over year but at a level that signals full employment, and GDP expanding at a 3.0% annual rate as of the second quarter of 2024.”

More recently, data pointing to a cooling labor market fueled debate among investors and analysts about the scope of the first cut of the easing cycle, with bond futures markets torn between expectations of a 25-basis-point or a 50-basis-point reduction.

More rate cuts through the end of the year and into 2025 are widely expected. However, Caldwell says the Fed may not be as aggressive in cutting rates from here.

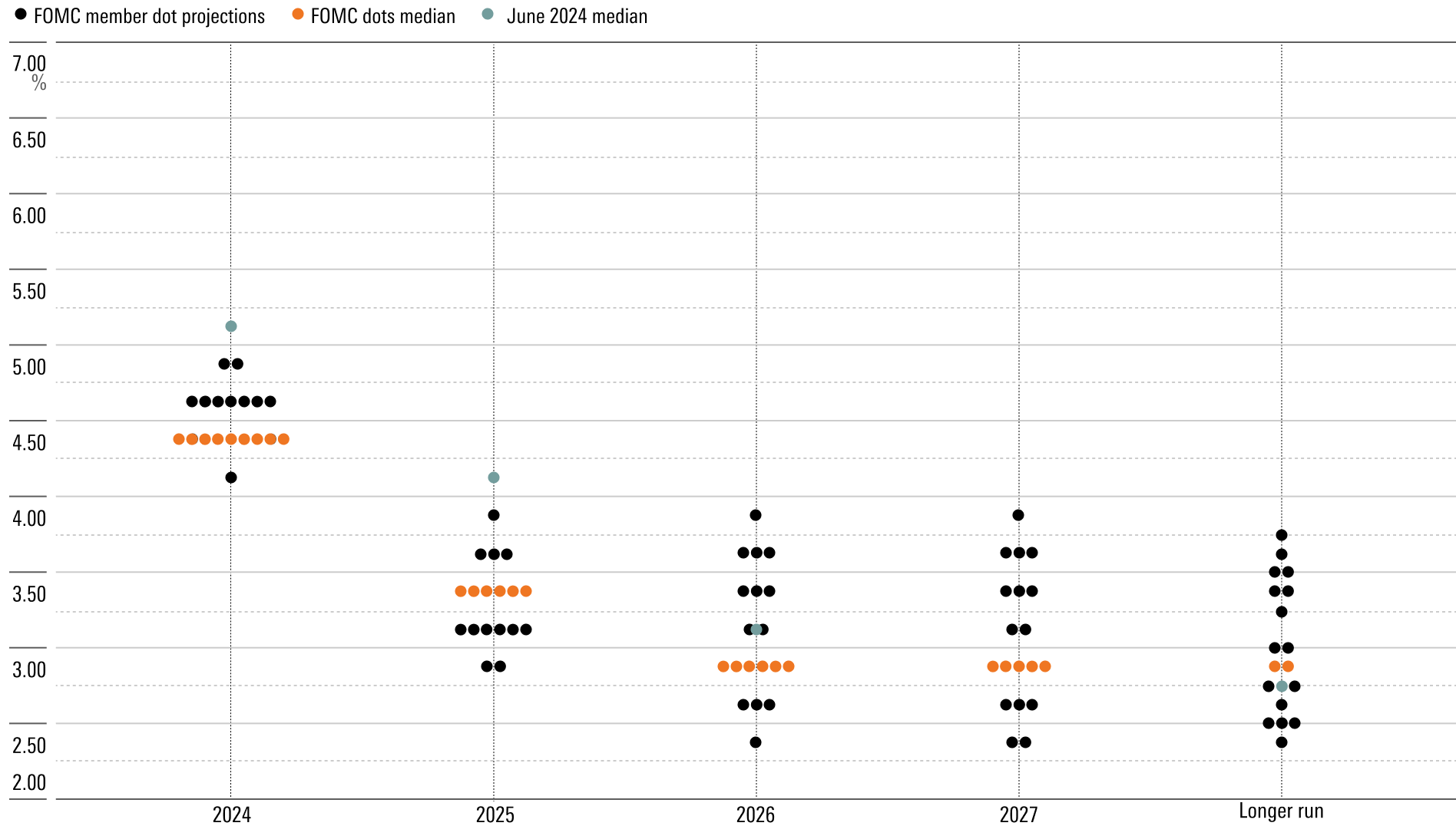

“The updated FOMC member projections imply quarter-point cuts in each of the November and December 2024 meetings, followed by a percentage point in cuts in 2025 to bring the federal-funds rate to 3.25-3.50% at end-2025,” Caldwell says. “That’s actually slightly above recent market expectations of 2.75-3.00% at end-2025. From that standpoint, today’s news is not entirely in the direction of looser monetary policy.”

The Dot Plot: Federal-Funds Rate Target Level