Table of Contents Show

Gold (XAU/USD) Eyes Fresh Highs, US-Russia Talks Fail to Quell Haven Demand

Most Read: Global Market Outlook 2025: Trends, Risks, and Opportunities for Traders

Risk aversion persisted in the markets today, even as a U.S.-Russia meeting in Saudi Arabia sparked hopes for a potential decline in safe-haven demand. Additionally, reports emerged of a phase two agreement being reached between Israel and Hamas.

Both developments carried the expectation of easing the geopolitical tensions that have weighed on global sentiment over the past 12 to 18 months. However, these events have so far failed to significantly alleviate the sense of geopolitical risk, keeping haven demand firmly in place.

US-Russia Talks in Saudi Arabia

A US and Russian delegation met in Saudi Arabia today to discuss a potential end to the Ukraine conflict. Market participants may have been eyeing a drop in geopolitics which may lead to a drop in Gold prices as haven demand falls. However this failed to materialize despite reports that the talks were positive.

Key Quotes and Reports from the Meeting from Both US and Russian Officials:

-US, Russia Agree To Appoint Teams To End Ukraine Conflict – US Official

-US Spox Bruce: One Call One Meeting Not Enough For Enduring Peace

-Russia’s Dmitriev: Russian, US Officials Have Separate Discussion On Future Economic Cooperation, Including Global Energy Prices – RTRS

-US, Russia Peace Proposal Would Include Ukraine Elections – Fox

-US State Sec Rubio: US, Russia Agree To Restore Embassy Staffing -AP

-U.S. National Security Adviser Waltz: There Will Be Talks About Territory And Security Guarantees

-US Sec Of State Rubio: Everyone Involved In Conflict Has To Be Part Of Talks

-US Sec Of State Rubio: European Union Needs To Be Involved At Some Point

-US National Security Adviser Waltz: US Allies Are Being Consulted On Ukraine

-US National Security Adviser Waltz: US Is Glad Europe Is Talking About Contributing More Forcefully To Ukraine Security

-Russia’s ForMin Lavrov: We Agreed To Form Process For Ukraine Conflict Settlement

-Russia’s ForMin Lavrov: There Were Also High Interest To Lift Barriers For Economic Cooperation

-Russia’s ForMin Lavrov: European Troops In Ukraine Is Unacceptable For Russia

-Russia’s ForMin Lavrov: I Can Say That Today’s Talks Were Not Unsuccessful

Despite the comments by Russia’s Foreign Minister Lavrov that the talks were not unsuccessful, the road ahead may be a long and bumpy one. Ukrainian President Volodymyr Zelenskiy announced that his visit to Saudi Arabia has been rescheduled for March 10th, as he awaits the arrival of the U.S. delegation in Kyiv. This could explain why markets have not had any meaningful reaction as of yet.

Israel-Hamas Phase Two Deal Appears on Course

In another positive for risk sentiment, both sides appear ready to discuss phase two of the ceasefire. Israeli Foreign Minister Gideon Saar stated that negotiations for the second phase of the hostage deal will commence soon. This view was echoed by Hamas Gaza Chief Hayya, who announced that the group is prepared to begin immediate negotiations for the second phase of the Gaza ceasefire agreement.

Another potential positive for geopolitical risk. Israeli Foreign Minister meanwhile acknowledged he is aware that Arab states are coming up with a plan for Gaza as Egyptian President Sisi is set to travel to Saudi Arabia for discussions. On the flip side however, the Israeli Foreign Minister has said they are unwilling to accept or support a plan that would see civilian control of Gaza transferred from Hamas to the Palestinian Authority.

Tariff Developments and the Week Ahead

The Dollar has so far had a limited impact on Gold prices. We have seen spikes when key data has missed estimates but the precious metal quickly recovers. This is a sign that haven demand and risk sentiment remains skewed in favor of further gains for Gold prices.

Tariffs by the US have heated up as well which continues to support Gold prices. President Trump has said that tariffs on automobiles would come on April 2, while Chinese lithium company Jiangsu Jiuwu Hi-Tech halted exports of processing equipment per LSEG.

Signs that a global trade war remains a massive concern for market participants moving forward.

On the data front, the FOMC minutes will be out on Wednesday followed by S&P PMI data on Friday. Both of these events could lead to a spike in volatility but i do expect any moves to prove short-lived.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

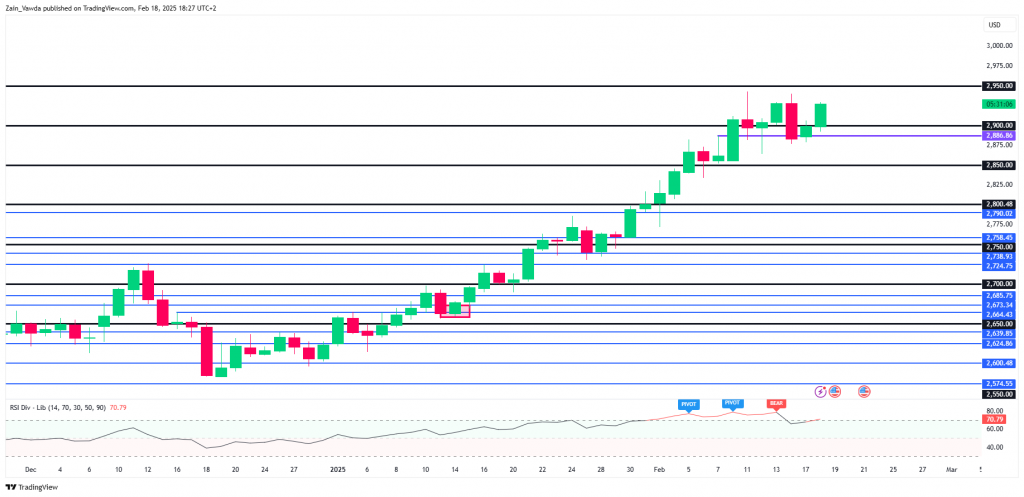

Technical Analysis – Gold (XAU/USD)

From a technical analysis standpoint, this analysis is a follow up from the technicals last week. Read: Gold (XAU/USD) Outlook: $3000/oz Target Possible as Safe Haven Demand Rises

Gold prices did experience a pullback last week following hotter than expected inflation data from the US. However this proved short lived as prices retested its alltime highs around the 2942/0z handle.

On the daily timeframe the RSI period 14 is back in overbought territory. As we know though, an instrument can remain in overbought territory for extended periods of time.

Gold (XAU/USD) Daily Chart, February 18, 2025

Source: TradingView (click to enlarge)

Dropping down to a four-hour chart H4, markets are in a sort of range with highs around 2937 and lows around 2881.

A rejection at 3937 could lead to a retest of support at 2924 and 2913 before the 2900 comes into focus.

On the upside, a break of 2927 and the all-time high at 2942 will see focus shift toward the 2950 and 2975 resistance handles.

Gold (XAU/USD) Four-Hour H4 Chart, February 18, 2025

Source: TradingView (click to enlarge)

Support

Resistance

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.