Table of Contents Show

Markets Today: Easing US-China Tensions Could Set Stage for Risk-On Sentiment, DAX Eyes Support

Asian Market Wrap

In what is expected to be a slower week on the Economic data front, markets appear to be cautiously optimistic. Trade tensions eased between President Donald Trump and China’s Xi Jinping after they resolved a dispute over critical minerals, opening the door for more trade discussions.

Top U.S. and Chinese officials will meet in London on Monday to try to ease the escalating trade dispute between the two countries. The conflict has grown beyond tariffs to include export controls on key goods and components affecting global supply chains.

/*

Requesting advertisement by calling an endpoint assures that

the advertisement is never cached together with the page.

I8psm – is a forced measure to prevent JS function from

being overwritten.

*/

function load_advertisement_I8psm(){

let adSlot = document.getElementById(‘ad-slot-container-I8psm’);

fetch(‘/load-advertisement/26/?is_sidebar=False’)

.then(response => response.text())

.then(html => {

adSlot.outerHTML = html;

})

.catch(error => {

console.error(‘Error fetching the template:’, error);

});

}

load_advertisement_I8psm();

At a yet-to-be-revealed location in London, both sides will work to revive a preliminary deal made last month in Geneva. That agreement had temporarily eased tensions and brought some relief to investors, who have been dealing with months of tariff announcements from President Donald Trump since his return to office in January.

Given that further talks are scheduled today between the US and China, Asian stocks went up, with Chinese shares in Hong Kong climbing 1.1% and nearing a bull market, a 20% rise from a recent low.

Overall sentiment does remain fragile and the lackluster data out of China this morning could keep growth worries firmly in the mind of market participants. This could for the time being, overshadow the growing optimism we are seeing. Positive US-China trade talks could go some way to mitigating these concerns and need to be monitored closely.

A major index for emerging market stocks also rose 0.7%, heading for its highest level since February 2022.

The dollar fell against all major Group-of-10 currencies.

Power Currency Balance

{

const imageElement = document.getElementById(‘pinch-to-zoom-img-2996’);

if (imageElement) {

panzoom(imageElement, {

maxZoom: 4.0,

minZoom: 0.5,

contain: ‘outside’,

});

}

}, 100);

}

}

}”

x-init=”$watch(‘imgModal’, value => initPanzoom())”

class=”flex justify-center “>

close

Source: OANDA Labs

Yields on 10-year Treasuries dropped slightly by 2 basis points to 4.49%, after jumping on Friday. Meanwhile, S&P 500 futures slipped 0.2%, and European stock futures fell 0.1%.

The European Open

With US-China talks drawing the attention this morning and a number of European markets closed due to holidays, European shares were somewhat subdued at the European open.

Markets in Switzerland, Denmark, and Norway, were closed for the Whit Monday holiday. The Pan European STOXX 600 was firm though at around the 553.2 point mark after four consecutive green sessions.

In individual stocks, London’s Alphawave surged over 23% after U.S. chipmaker Qualcomm agreed to buy the semiconductor company for around $2.4 billion.

Revolution Beauty rose 10.8% as billionaire Mike Ashley’s Frasers Group and others were reviewing the company for a possible takeover.

Economic Data Releases and Final Thoughts

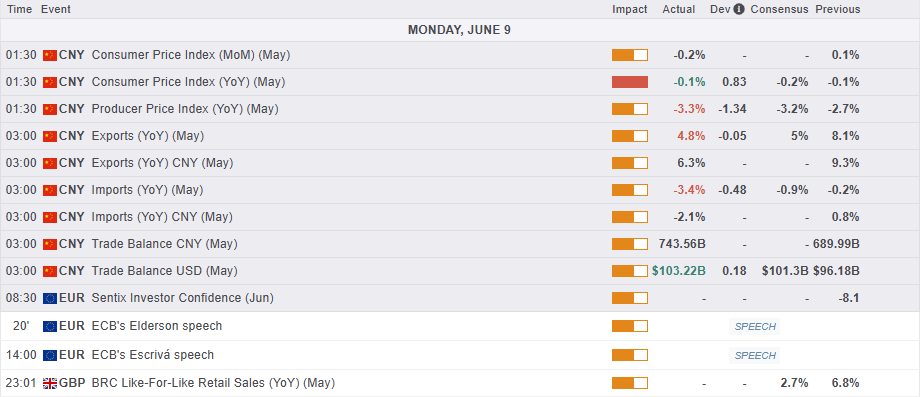

Looking at the economic calendar, the rest of the day sees focus shift to US-China talks and any developments on that front. The data calendar for Europe is light this week and that could leave markets eyeing overall sentiment and trade deal developments once more.

There is some UK data as the week progresses and of course the US inflation number on Wednesday which could shake up markets.

On the whole though, a much quieter week following last week’s barrage of data.

Markets will be hoping that the optimism gained at the back end of last week particularly regarding the health of the US economy may continue this week.

Positive developments on the US-China trade front and markets could see risk appetite return and push risk assets higher this week.

For a full breakdown and weekly market outlook, read Markets weekly outlook – US Inflation on Deck as Trade Uncertainty Lingers

{

const imageElement = document.getElementById(‘pinch-to-zoom-img-3324’);

if (imageElement) {

panzoom(imageElement, {

maxZoom: 4.0,

minZoom: 0.5,

contain: ‘outside’,

});

}

}, 100);

}

}

}”

x-init=”$watch(‘imgModal’, value => initPanzoom())”

class=”flex justify-center “>

close

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

/*

Requesting advertisement by calling an endpoint assures that

the advertisement is never cached together with the page.

LIE7j – is a forced measure to prevent JS function from

being overwritten.

*/

function load_advertisement_LIE7j(){

let adSlot = document.getElementById(‘ad-slot-container-LIE7j’);

fetch(‘/load-advertisement/30/?is_sidebar=False’)

.then(response => response.text())

.then(html => {

adSlot.outerHTML = html;

})

.catch(error => {

console.error(‘Error fetching the template:’, error);

});

}

load_advertisement_LIE7j();

Chart of the Day – DAX Index

From a technical standpoint, the DAX had printed a fresh high on Thursday last week but failed to kick on.

The DAX index is currently rangebound between the 23900-24350 handle on the daily timeframe. A daily candle close above or below these levels could open up the possibility of a more sustained move in either direction.

For now though, the index has pulled back slightly this morning with immediate support resting at the 24150 handle before the 24000 handle comes into focus.

On the upside immediate resistance rests at the top of the range around the 24350 handle before the Thursday high at around the 24491-24500 handle comes into play.

DAX Daily Chart, June 9, 2025

{

const imageElement = document.getElementById(‘pinch-to-zoom-img-1304’);

if (imageElement) {

panzoom(imageElement, {

maxZoom: 4.0,

minZoom: 0.5,

contain: ‘outside’,

});

}

}, 100);

}

}

}”

x-init=”$watch(‘imgModal’, value => initPanzoom())”

class=”flex justify-center “>

close

Source: TradingView

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Opinions are the authors’; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. The provided publication is for informational and educational purposes only.

If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please refer to the MarketPulse Terms of Use.

Visit https://www.marketpulse.com/ to find out more about the beat of the global markets.

© {CURRENT_YEAR} OANDA Business Information & Services Inc.