Table of Contents Show

New Silicon Investment Thesis

Sponsored By: Silicon Metals Corp

Silica? An overlooked investment opportunity with few quality publicly traded companies in the space. But what is it used for…

What you need to know:

- The EU declared Silicon a critical raw material as a wide range of modern technologies depend on it to make various industrial and consumer products. [1]

- Silicon was added to the US Department of Energy (DOE) List of Critical Materials for Energy in 2023. [2]

- Silicon metal was added to the Canadian critical minerals list in 2024. [3]

- The global silica market size was valued at USD 49.12 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030. [4]

In this report on the vibrant and rapidly expanding global silica market, we will delve into the factors driving its growth, the challenges faced by the sector, where we see it going over the next decade, as well as the players you should keep your eye on and why silica is an investment opportunity you shouldn’t miss.

What is Silica?

Silica (SiO₂), or silicon dioxide, is a chemical compound consisting of silicon and oxygen, commonly found in over 95% of rocks. [5] It exists in forms like quartz, cristobalite, and tridymite, and appears as a transparent white to gray, odorless powder.

With a high melting point of 3110°F and boiling point of 4046°F, [6] silica is insoluble in water but dissolves in substances like hydrogen fluoride. It is widely used in products such as cement, concrete, ceramics, glass, personal care items, and automotive components, serving roles as a filler, absorbent, abrasive, and more.

These basic use cases are only part of what makes silica special. Silica is an oxide of silicon (silicon dioxide), primarily found in quartzite in white sand or industrial sand. Silicon metal, derived from high-quality quartz containing between 96% and 99.99% silicon[6] is highly stable and doesn’t break easily under high temperatures, making it perfect for semiconductors, microchips, and solar panels.

The Importance of Solar

Solar PV accounted for 4.5% of total global electricity generation in 2022, and it remains the third largest renewable electricity technology behind hydropower and wind.

— International Energy Agency (IEA)[7]

There are approximately 6 kilograms of silicon in a 1 kW solar panel.[8] In 2023, global solar photovoltaic (PV) capacity reached approximately 1.6 terawatts (TW), or 1,600 gigawatts (GW). This significant milestone was achieved after a remarkable surge of 447 GW in new installations during that year. [9] This equates to roughly 9.6 expected to be deployed by 2030, considering the current growth trajectory, it is reasonable to assume that number will be in the tens of thousands.

Experts at the IEA expect there will be five terawatts of solar-generated electricity by 2030, resulting in a silicon demand of approximately 30 million tonnes of silicon. [10]This represents a 400% demand increase in solar alone.

Silicon and the AI Revolution

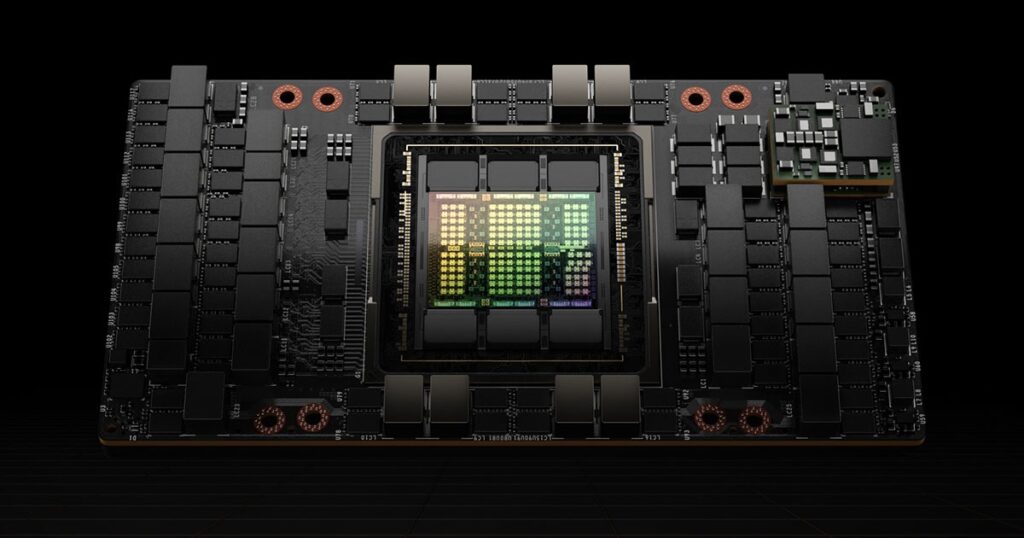

A DGX H100 AI server that contains 8 H100 NVIDIA GPUs contains approximately 1.5 kilograms of silicon. DGX systems are used widely by major cloud providers such as AWS, Google Cloud, Microsoft Azure, and Oracle for AI workloads. As such, there are several thousand currently in operation in a global AI market worth approximately $196.6 billion.[18]

Industry analysts estimate the AI sector will increase to $1.81 trillion USD at a CAGR of 36.6% by 2030.[18] While it is hard to predict an exact figure of DGX H100 servers.

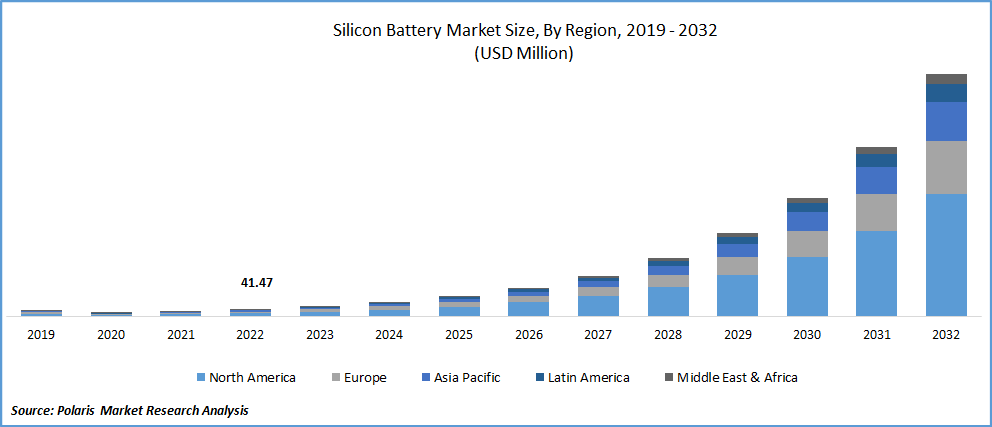

Energy Storage and Other Tech

What’s even more exciting is silicon’s long-held promise in the growing power storage market. Graphite is the traditional primary anode material for lithium-ion batteries, but silicon has shown the potential to hold 10 times as many lithium ions by weight as graphite, and major EV manufacturers like Porsche, Mercedes, and GM are already investing in developing the silicon anode technology. [11]

From energy storage to data storage, Microsoft is developing a novel new non-volatile solution that could replace our current magnetic-based chips with silica-based glass plates that are resistant to electromagnetic pulses and able to safely store several terabytes of data for thousands of years on a plate the size of a drink coaster. [12]

It’s Critical

China is currently the world’s largest producer of low-cost silicon. [13] Even though this has contributed to both the affordability and scalability of solar PV, it has also led to heightened competition for resources with China. This competition has affected domestic U.S.-based silicon solar cell manufacturers where domestic supply is limited.

To illustrate this silicon production imbalance, according to the USGS, the United States had an estimated 313,000 metric tons of silicon mine production in 2021. [14] By comparison, China had an estimated 6 million metric tons of annual silicon production in 2021. [15] This presents a huge problem as trade relationships between China and the West are becoming even more fractured.

As such, the United States has recognized silicon as a critical material, particularly in the context of its role in semiconductor manufacturing and the growing demand for energy transition technologies like batteries. In 2021, [16] the U.S. emphasized the importance of securing the supply chain for critical minerals, including silicon, through initiatives such as Executive Order 14017, aimed at reducing reliance on foreign sources and bolstering domestic production. Following suit, both Canada and the European Union have also recognized silicon as a critical material, updating their Critical Minerals Lists, and formalizing their cooperation through the Canada-EU Strategic Partnership on Raw Materials, which focuses on enhancing the resilience and sustainability of critical mineral value chains.

Securing the Silica Supply Chain

Even though quartz deposits are a dime a dozen, quartz deposits with purities of >96% or higher (high-purity quartz) are rare.[17]

Fortunately, there are domestic silica projects currently in exploration and development that meet those standards. Three such exploration stage projects are in the Silicon Metals Corp.’s portfolio (CSE: SI) The Longworth Silica Project, The Silica Ridge Project and The Ptarmigan Silica Project.

The Silica Ridge Property

The 2,538.22 Ha Silica Ridge property is host to a large quartzite occurrence which was most recently drilled by Silver Standard Mines Limited (“Silver Standard“) in 1975. At least five holes were drilled on the occurrence and summarized in a memo filed with the BC government by Silver Standard which states “five holes drilled in a relatively small area indicate a substantial tonnage of silica with the following analysis: SiO2 – 99.43 percent; Fe2O3 – 0.09 percent; Al2O3 – 0.08 percent; CaO – 0.011 percent; and LOI – 0.18 percent” (Property File: PF016434.pdf ). The work conducted by Silver Standard was confined to the northwest corner of the existing property leaving strong potential, based on current regional government mapping, to expand the known historic high-purity mineralization to the southeast along strike.

The Longworth Silica Property

The 3,863.06 Ha Longworth Silica property hosts a folded sequence of sedimentary and volcanic rocks which underlie Bearpaw Ridge. The Company is specifically targeting the Nonda Quartzite formation which strikes to the southeast and regionally shows multiple faulted offsets and folds. At least four northwest trending bands of quartzite have been mapped along the western flank of Bearpaw Ridge where thicknesses of the quartzite bands can reach up to approximately 400 metres.

The main quartzite band mapped on the property is folded and open to the northwest along strike. Previous reports on quartzite bands in the region have shown massive and homogeneous compositions of a high-purity silica (Minfile: MINFILE Mineral Inventory). Eight chip samples collected in 1982 by the Geological Survey Branch of British Columbia averaged 99.5 per cent silica (BCGS Open File 1987-15).

In the 1970’s Silver Standard was exploring for high-purity silica for use in the production of ferro silicon and silicon metal. In 1985 Silver Standard conducted a metallurgical program with the metallurgical engineering lab at the University of British Columbia. More recently in 2016, MGX Minerals Inc. reported SiO2 results up to 99.56% in the region.

The Company sees an opportunity to follow up on historical work and expand the known mineralization along strike to the southeast.[21]

The now ~4,000 Ha Ptarmigan Silica property is in British Columbia, Canada, on the side of Highway 16 approximately 135 kilometers from the community of Valemount hosts approximately 14 kilometers of discontinuous structure with silica grades ranging from 97% to 98% SiO₂. With nearly no contaminant minerals and room to expand along strike, the project is already off to a strong start, setting the stage for the development of a potentially interesting silica project in a mining-friendly jurisdiction with access to all important and necessary infrastructure.

Hardline Exploration Corp.’s field crews completed a 10 day exploration program on the Ptarmigan Project from October 22 – October 31. The program consisted of rock sampling and mapping, channel sampling, chip sampling, collecting bulk material for metallurgy and drone imagery surveys. Two hundred twenty-five samples were collected from the property including 205 outcrop grab samples, seven chip samples over 30m, and 11 channel samples over 24 metres of channel sampling. The Company is currently in the process of reviewing further high-quality silica projects to add to their portfolio, so definitely one to keep an eye on as it progresses and works to build out its portfolio of silica assets.

We currently reviewed three other existing silicon-focused public issuers. The three that we reviewed are:

- Homerun Resources (TSXV:HMR | OTC:HMRFF) – a Canadian vertically integrated silica explorer and developer with its flagship Belmonte silica project located in Bahia, Brazil.

- HPQ Silicon (TSXV:HPQ | OTC:HPQFF) – a company focused on developing multiple scalable silica processing technologies.

- Quebec Innovation Materials Corp. (CSE:QIMC) – a mineral and exploration company focused on the exploration and development of natural hydrogen gas and silica deposits in Quebec, Canada, with its flagship Charlevoix Silica Project located near Clermont, Quebec.

All three of these companies have been around for a few years and doing well. We feel there is much more growth opportunity in the sector, and believe a new entrant with the right projects will garner investor attention. Silicon Metals comes with a low valuation and a clean share structure giving the Company potential market cap growth as it moves its operations both technically and corporately forward. The Company has plans to acquire other high-grade silica assets and is definitely the one to keep on your watchlist.

Now that Silicon Metals Corp. (CSE:SI) has launched, there is a new entrant in the space where investors have the opportunity to review the issuer while it is currently trading at a low valuation with just ~26m shares outstanding, compared to the other companies we mentioned, and before a potentially larger audience is aware. For more information on Silicon Metals Corp. (CSE:SI), please find their investor presentation here and a link to the website here siliconmetalscorp.com.

In Conclusion

Silica prices are projected to experience continued growth, driven by the mineral’s critical status and pronounced demand increase. The global silica market is expected to reach a value of approximately $104.34 billion by 2030, at a CAGR of 9.9% from 2023 to 2030. [19]

As countries push toward eco-friendly manufacturing, silica’s benefits in reducing environmental impact are expected to further boost its demand.

All this points to an exciting future for silica. Its pivotal role in our 21st-century development presents an interesting investment opportunity for discerning investors who wish to enhance their portfolio growth while making the world a better place.

This is sponsored content for educational purposes only and not meant to be construed as financial advice. Omni8 Communications Inc. (DBA Omni8 Global) has been paid by Silicon Metals to provide marketing services pursuant to a consulting services agreement commencing on October 10 2024 for a period of seven months. In consideration for the services provided, Silicon Metals will pay Omni8 a cash fee of $7,500 CAD per month. Additionally, in connection with this report, Silicon Metals has paid Omni8 a cash fee of $50,250 CAD. This compensation should be viewed as a major conflict with Omni8’s ability to be unbiased. Omni8 and the Silicon Metals deal at arm’s length. Please review the full disclaimer

The reliability of historical estimates are considered reasonable but are unconstrained and a qualified person has not done sufficient work to classify the historical estimates as a current mineral resource or mineral reserve and the issuer is not treating any historical estimates as current mineral resources or mineral reserves and is included here for historic completeness only

Adrian Smith, P.Geo., is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Engineers and Geoscientists of British Columbia (EGBC) and is a registered professional geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed herein. Mr. Smith has not independently verified the historic samples reported in this report but has received data from the previous property owners and from the Government of BC’s online database.

For further information on the Ptarmigan Silica project, please see the Company’s technical report titled “Ptarmigan Silica Project Cariboo Mining Division NTS 093/H10 and 11 British Columbia, Canada NI 43-101 Technical Report” prepared on September 26, 2024 by Chris M. Healey, P. Geo Principal Geologist, Healex Consulting Ltd Engineers and Geoscientists British Columbia Member, which is available under the Company’s profile on SEDAR+ at www.sedarplus.ca.

Sources

- The EU declared Silicon a critical raw material as a wide range of modern technologies depend on it to make various industrial and consumer products.

Source: European Commission (2023). Critical Raw Materials Act. The European Union has listed silicon metal as a critical raw material due to its importance in various technologies.

Link: European Commission – Critical Raw Materials - Silicon was added to the U.S. Department of Energy (DOE) List of Critical Materials for Energy in 2023.

Source: U.S. Geological Survey (2023). U.S. Geological Survey Releases 2023 List of Critical Minerals.

Link: Energy.gov - Silicon metal was added to the Canadian critical minerals list in 2024.

Source: Government of Canada (2024). Critical Minerals List. Silicon is included in Canada’s list of critical minerals released in 2024.

Link: Government of Canada – Critical Minerals - The global silica market size was valued at USD 49.12 billion in 2022 and is estimated to grow at a CAGR of 9.9% from 2023 to 2030.

Source: Grand View Research (2023). Silica Market Size Worth $104.34 Billion By 2030 | CAGR: 9.9%.

Link: Grand View Research – Silica Market Report - Silica (SiO₂), or silicon dioxide, is commonly found in over 95% of rocks.

Source: Encyclopedia Britannica. Silicate minerals make up approximately 90% of the Earth’s crust, with silica being a major component.

Link: Britannica – Silica - Silicon metal is derived from high-quality quartz containing between 96% and 99.99% silicon.

Source: U.S. Geological Survey (2022). High-purity quartz is required for silicon metal production, typically containing over 95% silica.

Link: USGS – Silicon - “Solar PV accounted for 4.5% of total global electricity generation, and it remains the third largest renewable electricity technology behind hydropower and wind.”

Source: International Energy Agency (2022). Renewables 2022: Analysis and Forecast to 2027.

Link: IEA – Renewables 2022 - There is roughly 6 kilograms of silicon in a 1 kW solar panel.

Source: Apricum Group: To produce 6 kg of polysilicon, 480 kWh of electricity is required using technology that is dominant in the market today.

Link: Apricum Group - In 2023, global solar photovoltaic (PV) capacity reached approximately 1.6 terawatts (TW), with 447 GW of new installations during that year.

Source: SolarPower Europe (2023). Global Market Outlook for Solar Power 2023-2027. According to SolarPower Europe’s report, global solar PV capacity hit 1.6 TW in 2023, with a record-breaking 447 GW of new installations.

Link: SolarPower Europe – Global Market Outlook 2023-2027 - Experts at the IEA expect there will be five terawatts of solar-generated electricity by 2030, resulting in a silicon demand of approximately 30 million tonnes.

Source: International Energy Agency (2021). Net Zero by 2050: A Roadmap for the Global Energy Sector.

Link: IEA – Net Zero by 2050

Calculation: 5,000 GW × 6 kg/kW = 30 million tonnes of silicon. - Silicon has the potential to hold 10 times as many lithium ions by weight as graphite, and major EV manufacturers like Porsche, Mercedes, and GM are developing silicon anode technology.

Source: The Age of Silicon Is Here…for Batteries

Link: IEEE - Microsoft is developing a novel new non-volatile solution (Project Silica) that could replace our current magnetic-based chips with silica-based glass plates.

Source: Microsoft (2019). Project Silica proof of concept stores Warner Bros. ‘Superman’ movie on quartz glass.

Link: Microsoft – Project Silica - China is currently the world’s largest producer of low-cost silicon.

Source: U.S. Geological Survey (2022). Mineral Commodity Summaries – Silicon.

Link: USGS – Silicon Commodity Summary - According to the USGS, the United States had an estimated 320,000 metric tons of silicon mine production in 2021.

Source: U.S. Geological Survey (2022). Mineral Commodity Summaries – Silicon.

Link: USGS – Silicon Commodity Summary - China had an estimated 5.5 million metric tons of annual silicon production in 2021.

Source: U.S. Geological Survey (2022). Mineral Commodity Summaries – Silicon.

Link: USGS – Silicon Commodity Summary - The United States emphasized the importance of securing the supply chain for critical minerals, including silicon, through initiatives such as Executive Order 14017 in 2021.

Source: 100-Day Reviews under Executive Order 14017

Link: White House – Executive Order 14017 - Quartz deposits with purities of < 96% or higher (high-purity quartz) are rare.

Source: The Energy Transition is Running Low on High-Purity Silica Sand.

Link: Rockstone Research - The global artificial intelligence market size was valued at USD 136.55 billion in 2022 and is expected to reach USD 1.81 trillion by 2030, growing at a CAGR of 37.3% from 2023 to 2030.

Source: Grand View Research (2023). Artificial Intelligence Market Size, Share & Trends Analysis Report.

Link: Grand View Research – AI Market Report - The global silica market is expected to reach a value of approximately $104.34 billion by 2030, at a CAGR of 9.9% from 2023 to 2030.

Source: Grand View Research (2023). Silica Market Size Worth $104.34 Billion By 2030 | CAGR: 9.9%.

Link: Silica Market Size Worth $104.34 Billion By 2030 | CAGR: 9.9% - Longworth – MINFILE Detail Report – MINFILE Number: 093H 038

BC Geological Survey – Ministry of Energy, Mines and Petroleum Resources - Anzak – MINFILE Detail Report – MINFILE Number: 093O 013

BC Geological Survey – Ministry of Energy, Mines and Petroleum Resources