In the constantly evolving universe of investment opportunities, one metal is garnering increasing attention for its potential to reshape the global energy market all the while delivering substantial returns—Uranium. Uranium is a heavy metal which serves as an abundant source of concentrated energy and is best known for its use in nuclear reactions. As the world seeks sustainable and efficient solutions to meet its growing energy and transitioning demand, uranium which powers nuclear power plants is re-emerging as a pivotal energy source that will provide commercial stability and contribute to decarbonizing our economies. Over the last decade, uranium has been out of favor, with many counties moving to decommission plants and reduce nuclear energy use. France is a perfect example, pledging in 2014 to reduce their nuclear energy from 70% of the grid to 50% by 2025. However, the Russian invasion of the Ukraine prompted a harsh and quick reset of the worlds view of energy security, causing many countries such as US, Belgium, Finland and even Japan to revisit their policies on nuclear energy. Japan’s stance reversal is of particular significance given their complicated history with nuclear power: they are the only country to have ever suffered both a nuclear attack and a nuclear plant incident.

Countries who have been historically dependent on Russian energy and were thus severely affected by the Russian Invasion of Ukraine such as Germany and the United Kingdom have taken steps to ensure their already existing nuclear reactor fleets are operating at full power. The Russian invasion also prompted France to officially abandon their pledge to reduce nuclear energy use in their electrical grid. In fact, the French President Emmanuel Macron recently visited uranium rich Kazakhstan and Uzbekistan to further secure France’s energy footprint, as the country plans not only to continue to generate 70% of its energy from nuclear plants, but potentially increase their reliance on nuclear power. With nuclear energy re-emerging as part of the worlds plan of decarbonization and energy security, as economics would predict, the increased demand in uranium with no meaningful change in supply catapulted uranium futures contract prices over 80% in 2023. This rally also extended to ETFs such as Sprott Uranium Miners ETF (URNM), which invests in uranium miners and physical uranium, which rose 52% in 2023.

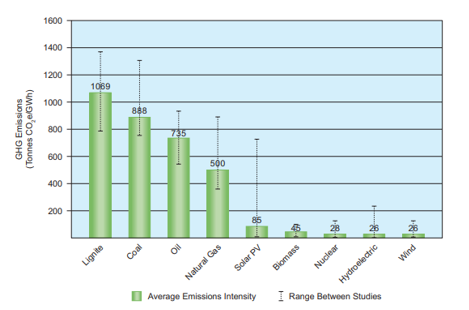

Uranium is a heavy metal which has been used as an abundant source of concentrated energy and is widely recognized for its use in nuclear reactors. While not particularly rare, uranium is approximately 500 times more abundant than gold and as common as tin ore—much like other metals, uranium extraction takes time and is difficult to ramp up and down at the drop of a hat. Bringing new supply online requires multiple years of capital expenditure to ramp up product in an existing mine, let alone break ground on a new one. The metal occurs naturally in low concentrations in soil, rock, and water, and is commercially extracted from uranium-bearing minerals such as uraninite. Uranium ore can also be mined from open pits or underground excavations. In the 70’s nuclear energy was expected to be a game changer for society. Nuclear energy however has suffered setbacks in the past due to negative public opinion, lack of understanding of the process, as well as disposal of nuclear waste. The data is clear however that nuclear energy produces lower greenhouse emissions than most methods of energy we currently use, in the chart below by The World Nuclear Association it shows nuclear energy produces even lower emissions than solar energy.

(Chart by the World Nuclear Associate)

Energy security and the urgency of decarbonizing the world’s economies while meeting the world’s increasing energy consumption needs are strong tailwinds for the uranium industry. According to the International Energy Agency, nuclear energy currently supplies approximately 9% of the global electricity, however they forecast nuclear power production to more than double by 2040. Developed economies have approximately 70% of global nuclear capacity, however they are losing leadership. Majority of the 50+ new reactors under construction are in emerging economies. Moreover, new innovation in the nuclear reactor space, such as small modular reactors (SMR), may fuel further project starts because they normalize the reactor blueprint, reduce construction costs, and enable nuclear power to be a financially viable energy source for small energy grids. All this, coupled with the lack of investment over the years have created a bottleneck on uranium supply and thus potential nuclear energy. In turn, tight supply has led to a demand push bidding war as countries and companies vie to secure as much uranium as the market allows them to.

From an allocators perspective uranium and nuclear energy creates an opportunity; as the great David Swensen said in his book Pioneering Portfolio Management, “In the future, the population of real asset alternatives might expand beyond the conservative investments of TIPS and the high return alternatives of real estate, oil and gas, and timber”. Inefficient markets and alternative asset classes such as real assets contribute to the portfolio construction process by pushing back the efficient frontier, enabling the creation of portfolios with higher returns for a given level of risk or with lower risk given a level of return. Exposure to uranium and the uranium ecosystem within a real assets allocation, similar to gold and gold miners could provide an additional source of uncorrelated return to a standard multi-asset portfolio.

The beauty of the ETF product is it has brought exposures that empirically may only have been available to large institutions or wealthy individuals to the retail investor, leveling the playing field. ETF’s such as URNM (Sprott Uranium Miners ETF), URA (Global X Uranium ETF), and NLR (VanEck Vectors Uranium+Nuclear Energy ETF), just to name a few have been pioneers in this niche space and their strategies have garnered over $4 billion in combined AUM. Thoughtful and strategic active management in the real assets space can help add additional alpha to a portfolio. For tangible evidence, I compared The Brinker Capital Focused Real Assets strategy to its passive benchmark (comprised of 25% Commodities, 25% Global Real Estate, 25% Global Infrastructure, and 25% Global Natural Resources). The Brinker Capital Focused Real Assets strategy invests in the investment universe; however it also utilizes valuation and momentum metrics to over and underweight the sub asset classes mentioned while also including actively managed ETFs to paint the edges. The actively managed Brinker Capital Real Assets strategy has outperformed the passively managed benchmark/approach in the 1-, 3-, and 5-year time periods. Not only has performance been superior, but risk measures are also more favorable.

Real assets passive benchmark: 25% Bloomberg Commodity TR USD, 25% DJ Global World Real Estate TR USD, 25% S&P Global Infrastructure TR USD, 25%, 25% S&P Global Natural Resources TR USD) BM is set to rebalance annually on calendar period end. . Real Assets Passive Benchmark has been used to track performance of Brinker Capita Focused Real Assets over time frames presented. Brinker Capital Focused Real Assets allocation (Inception August 2014): active/dynamic allocations used in the Brinker Capital Focused Real Assets strategy.) Data compiled from Morningstar. Net returns as of 12/31/2023.

Investors and allocators who employ alternative assets as legitimate tools in the portfolio allocation process reduce dependence on traditional marketable securities, which in essence facilitates a truly diversified portfolio. Uranium’s role in the transition to cleaner energy sources and its scarcity contributes to its appeal as an investment, with potential gains driven by the increasing importance of nuclear power in the global energy landscape.

In conclusion, uranium presents a compelling opportunity for those wishing to capitalize on the growing demand for clean energy, while also diversifying their portfolio. As the world strives to reduce carbon emissions and transitions towards sustainable sources, nuclear will and has taken a more pivotal role. It’s very important however that investors and allocators approach this sector with diligence by staying informed about regulatory developments, geopolitical factors, and market dynamics. The momentum of the clean energy movement and energy security has the potential to keep fueling the bull case for uranium and the nuclear industry.

Originaly Posted on ETFTrends