Powell hints at interest rate cuts; Wall Street cheers with big rally

Benzinga

| Detroit Free Press

Trump officials traded before tariffs announcements. What we know now.

Trump administration officials sold stocks days before key tariff announcements. Here’s what we know now about the timing and growing ethics concerns.

- Markets were caught off guard. Economists had expected a neutral stance, but Powell’s comments were widely interpreted as a green light for a September rate cut.

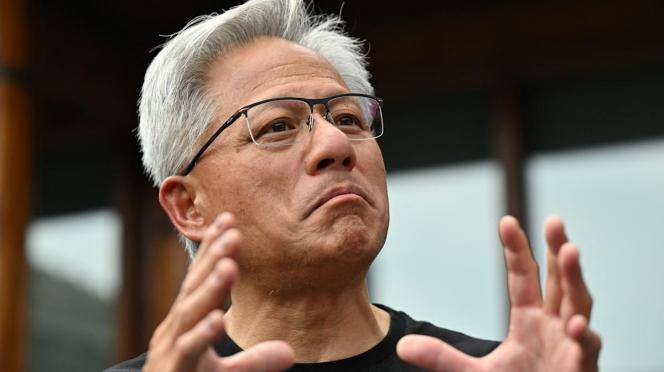

A week that began with a robust selloff in tech stocks, triggered by fading AI euphoria and a 20% drawdown in Palantir Technologies Inc., which specializes in software for data mining, ended with a euphoric rally across Wall Street on Friday, Aug. 22, powered by unexpectedly dovish signals from Federal Reserve Chair Jerome Powell.

Speaking at the annual Jackson Hole symposium, Powell said that with policy still restrictive and job market data weakening, the Fed could soon pivot — marking his clearest signal yet that rate cuts may be on the horizon.

Despite inflation still running well above the Fed’s 2% goal, Powell indicated that job creation has slowed dramatically and the balance of risks has shifted. The Fed, he suggested, is prepared to act if rising unemployment and slowing growth persist.

Powell also addressed inflationary pressures from tariffs. He said their impact on prices is “clearly visible,” but it might remain confined to a one-time price level adjustment, rather than a broader, persistent inflation trend. However, he also highlighted risks tied to a rise in inflation expectations.

Markets were caught off guard. Economists had expected a neutral stance, but Powell’s comments were widely interpreted as a green light for a September rate cut. Traders now fully price in a 25 basis-point reduction, which would bring the federal funds rate to 4%-4.25%.

Treasury yields tumbled and stocks rallied, with more speculative pockets of the market outperforming.

The Dow Jones Industrial Average surged past 45,600, setting new all-time highs. But the real momentum came from small caps: The Russell 2000 Index rallied to its highest level since December 2024, posting its strongest single-day performance since April 9.

Tesla led the Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, plus Tesla) and cryptocurrencies rallied across the board as investors expect looser financial conditions.

Michigan-based automaker stocks joined Aug. 22’s rally, with shares of General Motors Co. (up 2.7%, hitting their highest level since late November 2024), Ford Motor Co. (more than 3%) and Stellantis (nearly 5%) all up midday.

Benzinga is a financial news and data company headquartered in Detroit.