Siren Shareholders Vote to Approve Acquisition of Reefton Resources Pty Limited – Rua Gold

Rua Gold Inc. (TSXV: RUA, OTC: NZAUF, WKN: A4010V) (“RUA GOLD” or the “Company“) is pleased to announce that its previously announced proposed acquisition (the “Transaction”) of Reefton Resources Pty Limited (“Reefton”) was approved at today’s special meeting of the shareholders of Siren Gold Ltd. (ASX:SNG) (“Siren”). Reefton is a 100% owned subsidiary of Siren, with tenements located adjacent to the Company’s suite of properties in New Zealand’s prolific Reefton Goldfield.

Robert Eckford, CEO of RUA GOLD, stated: “Recognizing the strategic rationale to create a district scale exploration opportunity covering some of the highest-grade gold and antimony assets in the world, Siren’s shareholders overwhelmingly voted in favor of this transformational transaction. The combined Company benefits from having both the local Reefton teams working together and Brian Rodan, Chairman of Siren joining the RUA GOLD board. We have a proven Board and Management team, in a favorable jurisdiction, looking to generate superior returns for both Siren and RUA GOLD shareholders. Seeing the competing offer from Federation Mining made on October 14, 2024 only confirms our thesis on the high grade potential of this district and we are excited to deliver results.”

Closing of the Transaction is expected to occur in November 2024, subject to satisfaction of customary closing conditions for a transaction of this nature and the receipt of final approval from the TSX Venture Exchange (“TSXV”).

Actively Advancing a District-Scale Discovery in a Tier 1 Jurisdiction:

- Represents the next chapter in RUA GOLD’s development towards our goal to be a major gold producer in New Zealand.

- Newly consolidated project represents one of the least explored, high-grade gold districts in the world.

- Permits, access, and consents in place for aggressive drilling following a district-wide reassessment of targets and potential on the combined land package.

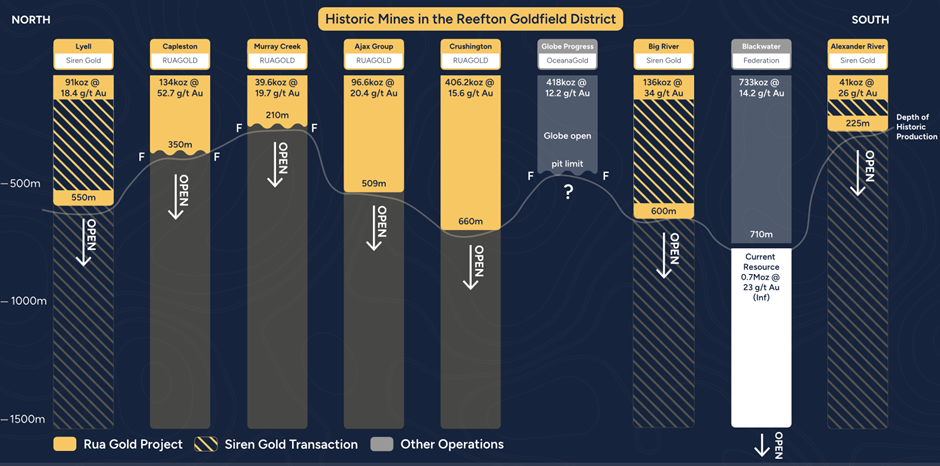

- The Transaction will increase regional tenement holdings from ~34k ha to ~120k ha and cover all known past production camps outside of Blackwater and the Globe Progress mine.

- Potential for lower overall project capital expenditures through the development of a potential central processing hub.

- The Transaction creates a bigger player in New Zealand, allowing greater opportunity to work alongside a pro-mining Government in helping them draft their Minerals Strategy for New Zealand.

- Backed by team of mining professionals with +150 years of combined experience.

Figure 1: Tenement map of the Reefton Goldfield.

Figure 2: Cross Section of historic underground mines in the Reefton Goldfield.

Transaction Highlights

Under the terms of the Amended Agreement, Siren shall receive total consideration of A$22 million (C$20.4 million):

- A$2 million (C$1.8 million) in cash, of which A$1 million has been paid and the remaining A$1 million will be paid at the close of the Transaction;

- A$2 million (C$1.8 million) in cash in exchange for 10,000,000 common shares of Siren, to be exchanged at the close of the Transaction; and

- 83,927,383 fully paid shares of RUA GOLD representing A$18 million (C$16.6 million[1]), to be issued at the close of the Transaction with agreed contractual resale restrictions.

Upon completion of the Transaction, Siren will own approximately 26% of RUA GOLD, and Siren Chairman, Mr. Brian Rodan, will join the RUA GOLD Board.

Advisors and Legal Counsel

Cormark Securities Inc. is acting as financial advisor to the Company and its Board of Directors. McMillan LLP is acting as Canadian legal counsel to the Company. Red Cloud Securities Inc. is acting as financial advisor to Siren and its Board of Directors. Steinepreis Paganin is acting as Australian legal counsel to Siren.

About RUA GOLD

RUA GOLD is an exploration company, strategically focused on New Zealand. With decades of expertise, our team has successfully taken major discoveries into producing world-class mines across multiple continents. The team is now focused on maximizing the asset potential of RUA’s two highly prospective high-grade gold projects.

The Company controls the Reefton Gold District as the dominant landholder in the Reefton Goldfield on New Zealand’s South Island. RUA GOLD will have approximately 120,000 hectares of tenements, following the completion of its previously announced acquisition of Reefton Resources Pty Limited[2], in a district that historically produced over 2 million ounces of gold grading between 9 and 50 grams per tonne.

The Company’s Glamorgan Project solidifies RUA GOLD’s position as a leading high-grade gold explorer on New Zealand’s North Island. This highly prospective project is located within the North Islands’ Hauraki district, a region that has produced an impressive 15 million ounces of gold and 60 million ounces of silver. Glamorgan is within 3 kms of OceanaGold Corporation’s biggest gold mining project, WKP.

For further information, please refer to the Company’s disclosure record on SEDAR+ at www.sedarplus.ca.

RUA GOLD Contact

Robert Eckford

Chief Executive Officer

Email: reckford@RUAGOLD.com

Website: www.RUAGOLD.com

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur and specifically include statements regarding: the Company’s strategies, expectations, planned operations or future actions; closing of the Transaction; effects and benefits of the Transaction; and receipt of final approval for the Transaction from the TSXV. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company’s control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: general business, economic, competitive, political and social uncertainties; risks related to the effects of the Russia-Ukraine war; risks related to climate change; operational risks in exploration, delays or changes in plans with respect to exploration projects or capital expenditures; the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in labour costs and other costs and expenses or equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, flooding or unfavourable operating conditions and losses, insurrection or war, delays in obtaining governmental approvals or financing, and commodity prices. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements and reference should also be made to the Company’s CSE Form 2A – Listing Statement filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

[1] Calculated using RUA GOLD’s 30-day VWAP on the CSE as of July 12, 2024 of C$0.1983 at an AUD:CAD exchange rate of 0.9246.

[2] Refer to news released dated July 15, 2024.