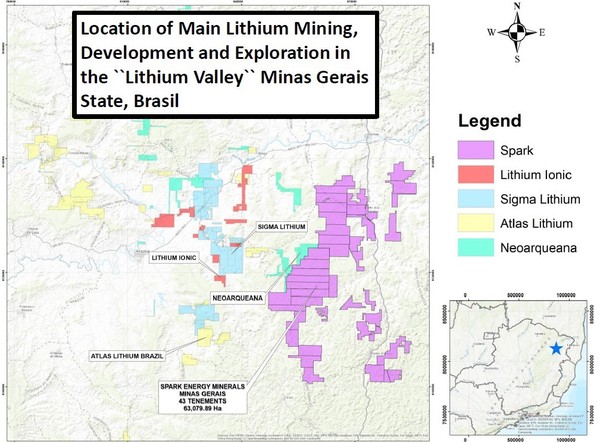

SPARK ENERGY—EMIN-CSE/MTEHF-OTC has a $4 million market cap—tiny tiny tiny, trading at 6 cents.But it has the largest land position—by A LOT—in Brazil’s lithium valley, where Sigma Lithium (SGML-TSXv) is building their lithium mine that will be in production late this year. Sigma ran from $1.50 – $54 in the lithium boom of 2022.

Lithium prices and sentiment is bottoming in H1 24, as Bloomberg reports that “UBS Group AG and Goldman Sachs Group Inc. have trimmed their 2024 supply estimates by 33% and 26%, respectively, while Morgan Stanley warned about the growing risk of lower inventories in China.”

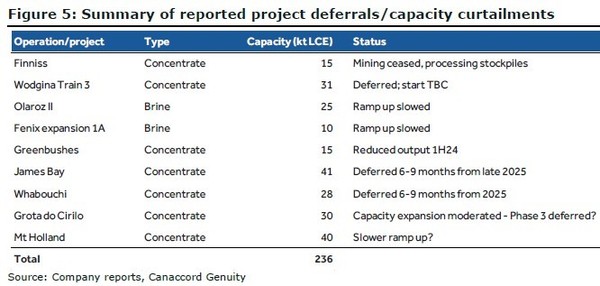

Canadian brokerage firm Canaccord outlined a list of new projects that are getting delayed…or worse.

And EV sales continue to go up—just not as fast as car dealers want. But CNBC is reporting that both hybrid and full EVs sold over 1 million units in the US last year, and growth is continuing. We still need more lithium—especially lithium outside of China.

So, I’m either buying a very cheap stock right at the bottom, or just as prices start to turn up. Spark has 63,000 hectares, or 155,000 acres of land—multiples of what everybody else has.

Their exploration is run by Jon Hill, who was Exploration Manager for Anglo Ashanti in Brazil for 30 years. Now, Jon is only a consultant here; he works for several exploration companies in various metals.

But he know everybody, he knows all the geology—he has been living in this area of Brazil for 30 years. He’s talented, experienced, and he and his team—Exploration Outcomes—are collating and exploring for a big lithium discovery here for Spark.

Investors KNOW what Jon and Exploration Outcomes will find—many pegmatite dikes that measure ones to tens of metres wide that contain 1.25% lithium. That’s what EVERYBODY is finding in Brazil’s lithium valley.

(It’s the same in the Canadian Shield—all those junior explorers are finding dikes with the same grade and widths—just how many are there on each property?)

What Jon and investors can’t know is..how long will that take, can they raise enough money, how many dikes and will they be close enough together—will they find a CLUSTER of them—to make an economic deposit.

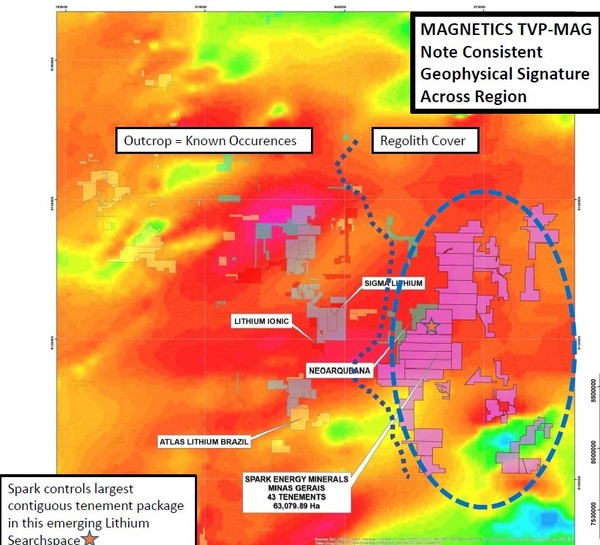

Because Spark’s ground is under cover (the dikes don’t outcrop; you can’t see them by just walking over the ground), nobody else wanted it in the heyday of the lithium rush in 2022.

So Spark’s team picked up this huge land package CHEAP.

And it has the same magnetic features as the much more advanced (and much higher market cap) neighbors have in Brazil’s lithium valley.

Exploration Outcomes has been studying the press releases of Spark’s peer group, companies like Lithium Ionic and Sigma and Atlas Lithium Corp, seeing what exploration is working and what management is saying about trends, techniques and results. All those stocks are 10-100x the market cap of Spark.Spark now has a huge database of public domain intelligence they can use to vector in on the best targets for this massive land package. And then Jon Hill also has some techniques he has learned in his 30 years in this area.

Do you remember what James Coburn said in the movie Baltimore Bullet—”Kid, I taught you everything you know. I didn’t teach you everything I know.” That’s Jon Hill.

Exploration Outcomes has a set of satellite based techniques that in total only cost US$20,000, that he thinks can pull out some great targets at 10 meter spacings—out of a 63,000 hectare property!

Written by Investing Whisperer