Table of Contents Show

Markets Weekly Outlook – PMI Data and Increased Liquidity to Drive Markets

Read More: Japan’s corporate service inflation rises, yen steady

Week in Review: Wall Street Falters After Christmas Break

A strong week with a gain of 1.08% on the first day of the ‘Santa Rally’ (last trading day before Christmas). Bulls are excited! Since 1969, each time the S&P 500 has gained 1% or more on the first day of the Santa Claus Rally, it has been positive 100% of the time during the full rally period, with an average gain of 1.7%

Source: Carson Investment Research (click to enlarge)

Tech and growth stocks pulled Wall Street’s main indexes down on Friday, capping off a positive, shorter trading week known for usually being a strong time for markets.

Growth stocks sensitive to interest rates fell, with Nvidia dropping 3%, Tesla losing 3.8%, and Microsoft down 2%. Ten of the 11 major S&P sectors also dropped, with information technology and consumer discretionary seeing the biggest declines at around 2% and 1.9%, despite leading much of the market’s gains in 2024.

Will markets get the strong end to the Santa Clause rally ahead of January 1 next week?

The US Dollar Index (DXY) continued its advance this week and is on course for marginal gains. More importantly the Index is on course for a daily candle close above the 108.00 handle.

Despite the stronger US Dollar, EUR/USD and GBP/USD remained steady and held their ground with marginal losses to end the week.

The Japanese Yen bounced back from a five-month low against the dollar on Friday. This came after the Bank of Japan’s December meeting notes showed some policymakers becoming more confident about a possible rate hike soon. The central bank also reduced its monthly bond purchases which helped the Yen finish the week on a positive note.

Oil prices went up by about 1% on Friday and were on track for a weekly increase, despite light trading as the year-end approaches. The rise was supported by expectations of lower U.S. crude stockpiles and hopes for an economic recovery in China driven by stimulus measures.

Gold prices had a mixed week, edging higher for the majority of the trading week before dropping back closer to the 2600/oz mark to end the week. Gold continues to find support due to the growing list of uncertainties expected in 2025 while the stronger US Dollar is likely to cap the upside potential moving forward.

The Week Ahead: Data Remains Slow but Liquidity Likely to Return

Asia Pacific Markets

The week ahead in the Asia Pacific region still remains light on the data front.

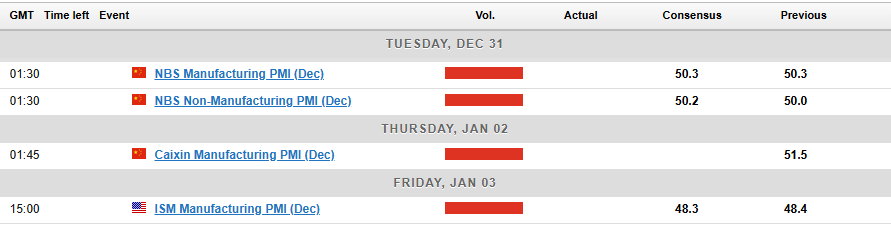

The highlight will be PMI data from China which could have ripple effects across various commodities. Manufacturing in China is key to global oil demand as well which adds further weight to the data release. Given the recent stimulus measures that have been put into effect by Chinese authorities, markets will be looking for signs of an improvement across the board in the coming weeks.

The NBS manufacturing PMI will be released on Tuesday while the Caixin manufacturing PMI will bring the week to a close on Thursday.

Europe + UK + US

In developed markets, it is a quiet week for Europe and the UK with the only high impact data release coming from the US.

The biggest data release from the US will be out on Friday with the manufacturing PMI data release. The US economy has remained resilient in 2024 with many expecting a blockbuster year under President Elect Donald Trump in 2025.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Chart of the Week

This week’s focus remains on US Equities and the S&P 500 in particular following its recovery and the start of the Santa Rally.

The S&P 500 looked set for a strong week heading into Friday, trading up around 3% for the week. However Friday’s tech and growth stock inspired selloff leaves the index with marginal gains for the week.

Given all the talk of the Santa Rally, the performance of the index on December 24 set the stage for a strong finish to the year. As we mentioned at the start of the article, Since 1969, each time the S&P 500 has gained 1% or more on the first day of the Santa Claus Rally, it has been positive 100% of the time during the full rally period.

With that in mind, the S&P 500 is now trading almost 1.7% lower than the December 24 high meaning the S&P could potentially rally around 1.7% before next Tuesday when the Santa Rally period ends. Will history repeat itself and the S&P 500 deliver?

Looking at the daily chart below, one can see that the overall bearish trend which began following the massive selloff on December 18 remains intact. The index needs a daily candle close above the swing high at 6072 to signal a shift to bullish structure.

There is also the possibility that the index could rise and test this week’s high on Monday or Tuesday next week before falling once more. In this way the index could maintain its historical Santa Rally performance while maintaining its current bearish trajectory, leaving the index open to further downside.

Given the optimism around the US economy with the Trump administration, the probability of a break higher remains strong. Thus despite the current technical picture one cannot overlook these key fundamental themes as well.

S&P 500 Daily Chart – December 27, 2024

Source:TradingView.Com (click to enlarge)

Key Levels to Consider:

Support

Resistance

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.