Table of Contents Show

Markets Weekly Outlook – US Dollar’s Fate Hinges on NFP as Fed Rate Cut Looms

Read More: USD/JPY Price Outlook – Yen Extends Gains as Key Confluence Level Approaches

Week in Review: Geopolitics Drives Market Sentiment

A week largely dominated by geopolitical developments as the US celebrated the Thanksgiving Holidays ended with somewhat of a whimper. The lack of liquidity was evident on Thursday and Friday as markets looked to make sense of broad development along the geopolitical sphere.

Donald Trump kicked off the week with the threat of tariffs, his main targets being Mexico, Canada and of course China. Mexican President Claudia Sheinbaum did not take it lying down as she floated the idea of retaliatory tariffs. Brave of the incoming President but still a concern for market participants which also had an effect on currencies like Australian Dollar due to the country’s ‘commodity currency’ status and trade relationship with China.

Technically, Trump could use an executive order to implement tariffs on his first day in office. However, in reality, the timing is unclear. It’s likely the tariffs will be tied to his proposed tax cuts, and such a detailed plan would take time to get approval from Congress. Let’s see how this develops.

Israel and Hezbollah agreed to a ceasefire that began on Wednesday. Israel views its mission in Lebanon as a success, having eliminated much of Hezbollah’s leadership and destroyed many of its weapons. Hezbollah meanwhile views it as a success that Israel gained no ground in Southern Lebanon. A stalemate resembling the 2006 battle between the two. While the ceasefire offers hope in a conflict-filled region, achieving lasting peace will still take time.

The impact saw Oil prices face challenges as the geopolitical risk premium has for now at least disappeared. The only positive being that since an initial selloff on Monday Brent Crude prices remained rather steady for the rest of the week with a lot of choppy price action. Brent remains on course to finish the week around 3.1% down.

US equities enjoyed a surprisingly strong finish to the week with the S&P printing fresh record highs thanks to tech and retail stocks. Technology stocks, including Nvidia, helped raise the S&P 500, while industrial and financial stocks boosted the Dow. Nvidia’s stock went up by 2.4%.

Meanwhile, investors watched how shoppers reacted to big Black Friday discounts. Adobe Analytics predicted online spending would hit a record $10.8 billion, a 9.9% increase compared to last year’s Black Friday.

The S&P is on course for its biggest one-month rise since November 2023. The Russell 2000 index hit a record high earlier in the week, on pace for its steepest monthly rise so far this year.

The performance of Wall Street Indexes is reflected in fund flow data with investors pumping a substantial $12.19 billion into global equity funds, a jump of 32% compared with about $9.24 billion worth of net acquisitions in the week before, LSEG Lipper data showed. It marked the ninth consecutive weekly inflow.

Source: LSEG Data

The DXY struggled this week as the probability of a December rate cut from the Federal Reserve increased around 10%. A lot of this came down to the Fed meeting minutes release as well as robust jobs data.

Despite this USD weakness EUR/USD failed to break above the 1.0600 handle with Cable gaining some ground to trade back above the 1.2700 handle. Gold (XAU/USD) experienced a massive selloff to start the week but held above the $2600/oz handle before making its way back above the $2650/oz handle.

The precious metal will still finish the week down around 2% having traded at a peak of around $2720/oz in the early hours of Monday morning.

The Week Ahead: US Jobs Data to Dominate

Asia Pacific Markets

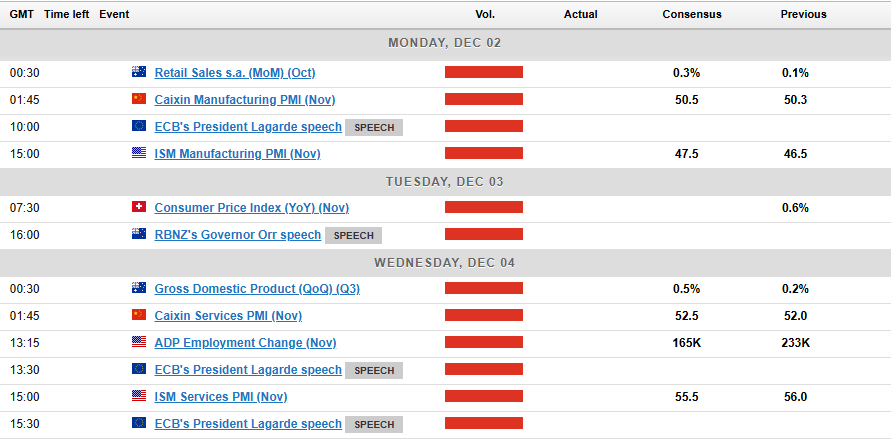

The week ahead in the Asia Pacific region sees an uptick in economic data releases.

In China, PMI data will be important this week. On Saturday morning, the National Bureau of Statistics (NBS) will release the official manufacturing and non-manufacturing PMI. There is an expectation that the manufacturing PMI will rise slightly to 50.3 from 50.1, showing signs of steady growth. The Caixin manufacturing PMI will be out on Monday.

In Japan, real cash earnings might see a small growth of 0.1% year-on-year in October. With strong labor earnings, the Bank of Japan could raise interest rates in December.

In Australia, markets have quite a bit of high impact data to deal with. Having had a bumper week in lieu of tariff threats against China which sent the Aussie through some volatility the week ahead may prove similar.

Retail sales kicks things off on Monday before we get some GDP data on Wednesday and to round the week off, trade balance data will be released on Thursday.

Europe + UK + US

In developed markets, the focus moves back to the US and jobs date with the NFP due out for release on Friday.

Last month, non-farm payrolls only increased by 12,000, much lower than expected. Hurricane Milton caused big job losses in Florida, where employment dropped by 38,000 compared to its usual growth of 13,000.

This suggests that Hurricane Milton has had a significant impact on payroll data, now with those issues out of the way there is a chance the number could be higher this week. A print around the 220k mark is very much a possibility with the unemployment rate also key to help the Fed ahead of the December meeting.

If unemployment rises to 4.2% and jobs growth comes in around the 220k mark there is a greater chance of a Fed rate cut in December and this could lead to US Dollar weakness.

In Europe and the UK there is a lack of high impact data releases. However we do have a speech by ECB President Christine Lagarde on Wednesday which could provide some insight into where the ECB is leaning regarding December rate cuts.

The slight improvement in Eurostat sentiment as well as the uptick in German inflation which rose to 2.2% year-on-year, up from 2.0% YoY in October will likely rule out a 50 bps cut. Any sign from Lagarde in her speech could stoke some short-term volatility for the Euro.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Chart of the Week

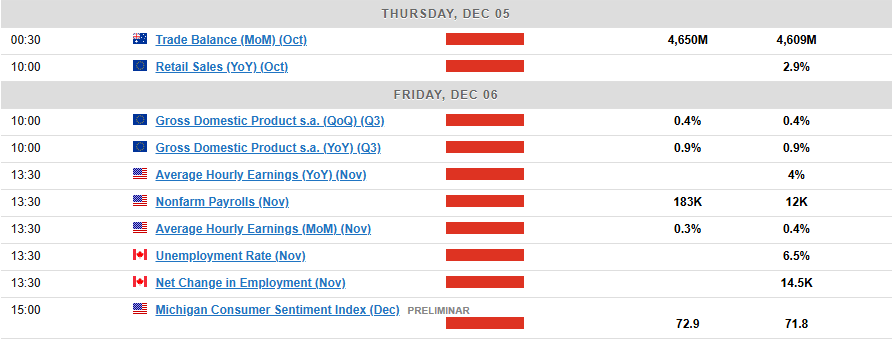

This week’s focus could have been either USD/JPY that has a broken a key medium-term ascending trendline or the chart i have chosen which is GBP/USD.

Cable has benefited from rising expectations that the Bank of England (BoE) will hold rates steady at the December meeting while the Fed are now projected to cut by 25 bps. The impact of this repricing has seen GBP/USD push away from support at the 1.2500 key level to trade just shy of resistance at 1.27500.

As things stand GBP/USD is at intriguing area heading into next week. Price is currently just below resistance at 1.2750 with a key confluence area around the 1,2800 handle where you have the descending trendline and the 200-day MA at 1.2819.

This as the RSI period 14 approaches the 50 neutral level with a break above likely signaling a shift in momentum. If this coincides with a trendline break bulls may be emboldened and this could push GBP/USD toward the 1.3000 psychological level once more. A lot of this will hing on the DXY as well and how the US Dollar performs next week.

A trendline rejection could lead to a retest of the 1.2750 and 1/2618 support areas. A break of these areas could see sellers return and push price beyond the previous lows of around 1.2480. An interesting week ahead indeed.Equity

GBP/USD Daily Chart – November 29, 2024

Source:TradingView.Com (click to enlarge)

Key Levels to Consider:

Support

Resistance

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.